February Home Prices Increase by 4.2% Annually

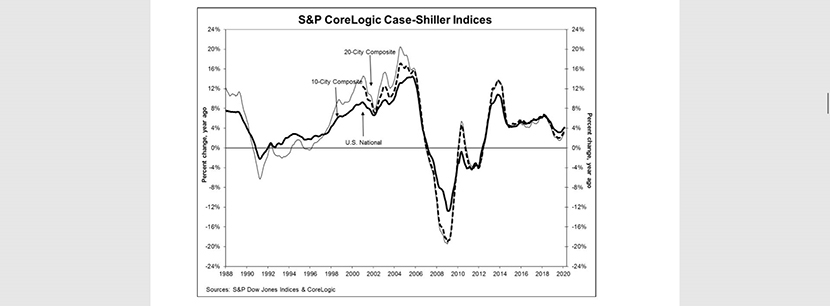

S&P Dow Jones Indices, New York, said its CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 4.2% annual gain in February, up from 3.9% in January.

The 10-City Composite rose by 2.9% annually in February, up from 2.6% in January. The 20-City Composite posted a 3.5% year-over-year gain, up from 3.1% in the previous month. Phoenix led with a 7.5% year-over-year price increase, followed by Seattle at 6.0%, and Tampa and Charlotte at 5.2%. Seventeen of the 20 cities reported higher price increases in the year ending February.

Month over month, the National Index and the 10-City Composite both posted an 0.4% month-over-month increase, while the 20-City Composite posted an 0.5% increase before seasonal adjustment in February. After seasonal adjustment, the National Index posted a month-over-month increase of 0.5%, while the 10-City and 20-City Composites both posted 0.4% increases. Nineteen of 20 cities reported increases before seasonal adjustment while all 20 cities reported increases after seasonal adjustment.

“The stable growth pattern established in the last half of 2019 continued into February,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P Dow Jones Indices. “Importantly, today’s report covers real estate transactions closed during the month of February, and shows no signs of any adverse effect from the governmental suppression of economic activity in response to the COVID-19 pandemic. As much of the U.S. economy was shuttered in March, next month’s data may begin to reflect the impact of these policies on the housing market.”

The report said as of February, average home prices for the MSAs within the 10-City and 20-City Composites are back to their winter 2007 levels.

Selma Hepp, Deputy Chief Economist with CoreLogic, Irvine, Calif., said the report “confirms that U.S. home price growth was in a prime economic growth state, prior to COVID-19, with low mortgage rates, rising family income and a lean inventory of homes for sale to kick-off the year’s quick growth.”

Hepp said the report showed “strong enthusiasm” in the housing market prior to the COVID-10 pandemic. “Home buyers, particularly millennials, were encouraged by falling mortgage rates and a strong employment market. But, developing insights into COVID-19 impacts on the U.S. economy put some uncertainty around housing markets. Mortgage rates remain historically low and millennials are still active in the market, which suggests that while the spring home-buying season may be disappointing, there are promising fundamentals for the housing market when the economy picks up speed again.”