Homeownership Rate Ticks Up to 65.3%

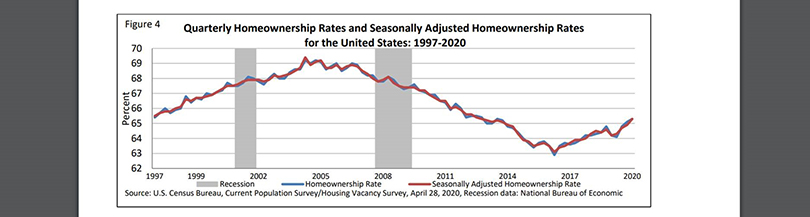

Pre-coronavirus, the nation’s homeownership continued its recovery in the first quarter, rising by 1.1 percent from a year ago to 65.3 percent, the Census Bureau reported yesterday.

The report said national vacancy rates in the first quarter were 6.6 percent for rental housing and 1.1 percent for homeowner housing. The rental vacancy rate fell by 0.4 percentage points from a year ago (7.0 percent), but not statistically different from the fourth quarter (6.4 percent). The homeowner vacancy rate of 1 was 0.3 percentage points lower than a year ago (1.4 percent) and the fourth quarter (1.4 percent).

The homeownership rate of 65.3 percent was 1.1 percentage points higher than a year ago (64.2 percent) but up only slightly from the fourth quarter (65.1 percent).

“Data for the first quarter of 2020 continue to reflect the extremely strong housing market prior to the current COVID-19 pandemic and subsequent economic crisis,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. Homeowner vacancy rates dropped to the lowest level in more than 40 years, and the rental vacancy rate also remained quite low. Moreover, the homeownership rate increased to its highest level in almost eight years. Without a doubt, the rapid deterioration of the job market this spring will cause second quarter numbers to reverse course.”

The report said the median asking sales price for vacant for sale units rose to $225,200.

Census said 88.6 percent of the housing units in the United States in the first quarter were occupied, with 11.4 percent vacant. Owner-occupied housing units made up 57.9 percent of total housing units, while renter-occupied units made up 30.7 percent of the inventory in the first quarter. Vacant year-round units comprised 8.8 percent of total housing units, while 2.6 percent were vacant for seasonal use.

The report said 2.2 percent of total units were vacant for rent; 0.7 percent were vacant for sale only; and 0.6 percent were rented or sold but not yet occupied. Vacant units that were held off market comprised 5.3 percent of the total housing stock – 1.5 percent were for occasional use, 1.0 percent were temporarily occupied by persons with usual residence elsewhere and 2.9 percent were vacant for a variety of other reasons.