U.S. hotel profitability metrics cratered during April, reported STR, Hendersonville, Tenn. During April, the sector saw total revenue per available room fall nearly 93 percent year-over-year and gross operating profit per available room fall 116.9 percent to a $17.98 loss per room.

Category: News and Trends

MBA Advocacy Update

On Tuesday, HUD Secretary Ben Carson and FHFA Director Mark Calabria testified before the Senate Banking Committee about how their agencies are assisting homeowners and renters during the COVID-19 pandemic. On Wednesday, MBA along with several industry trade and housing advocacy organizations sent a letter to HUD on FHA’s new early payment forbearance policy.

Industry Briefs

Stewart Information Services Corp., Houston, acquired United States Appraisals. Stewart said the acquisition strengthens its digital real estate services offering in appraisal and valuation management and enhances its existing title insurance, settlement services, appraisal/valuation and other real estate services.

MISMO Looks to Standardize Data Used to Guide Borrower Outreach

MISMO®, the mortgage industry standards organization, said it will evaluate the need for standards to facilitate early identification of loans that may become delinquent or be in distress.

The Week Ahead

Good morning! By this coming weekend, the strangest spring in memory will give way to…probably the strangest summer in memory.

Dealmaker: Berkadia Secures $58M for Multifamily

Berkadia secured $57.5 million for multifamily properties in Florida and Wyoming. In Orlando, Berkadia secured a $31.5 million loan for The Residences at Veranda Park, a 150-unit mid-rise property with …

MBA’s Kelli Burke Named #NEXTPowerhouseAwards Winner

Kelli Burke, MBA Vice President of Commercial Real Estate Finance, has been named an award recipient of the #NEXTPowerhouseAwards, presented by NEXT Mortgage Events & News. She will be recognized at #NEXTSUMMER20, the group’s first virtual executive summit, taking place August 23-25.

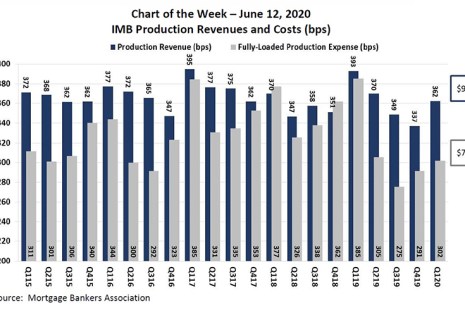

MBA Chart of the Week: IMB Production Revenues & Costs

MBA last week released its Quarterly Performance Report for the first quarter. The total sample of 336 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 61 basis points (or $1,600) on each loan they originated – a solid showing particularly for a first quarter.

FCRA and the CARES Act: Putting in Right Procedures Now, Reducing Volume of Litigation Later

Over the past 10 years, Fair Credit Reporting Act lawsuits have almost quadrupled from some 1,350 cases in 2010 to 5,000 in 2019. FCRA allows plaintiffs to recover attorney fees, which may explain the increase.

Quote

“Kelli [Burke] is a core member of MBA’s commercial-multifamily team, and her background, deep industry knowledge, and execution help her effectively engage with and advocate on behalf of our members. I can think of nobody more deserving of this recognition and am confident she will continue to deliver substantive results for our members.”

–MBA Senior Vice President of Commercial/Multifamily Policy and Member Engagement Mike Flood, on MBA Vice President Kelli Burke’s selection for the #NEXTPowerhouseAwards, presented by NEXT Mortgage Events & News.