Good morning! Welcome to a short but busy week ahead of the Independence Day holiday.

Category: News and Trends

MBA: 1st Quarter Commercial/Multifamily Mortgage Debt Outstanding Up 1.7%

Commercial/multifamily mortgage debt outstanding rose by $61.0 billion (1.7 percent) in the first quarter, according to the Mortgage Bankers Association’s quarterly Commercial/Multifamily Mortgage Debt Outstanding report.

May Commercial Real Estate Sales Slump

Real Capital Analytics, New York, reported commercial property sales sank again in May as the COVID-19 crisis kept investors on the sidelines.

Dealmaker: Dwight Capital Closes $63M

Dwight Capital, New York, closed $63 million in multifamily loans in Oregon, Arizona and Massachusetts.

Final 1Q GDP Estimate Shows Economic Growth Down 5%

Real gross domestic product decreased by 5 percent in the first quarter, according to the third (final) estimate released Thursday by the Bureau of Economic Analysis.

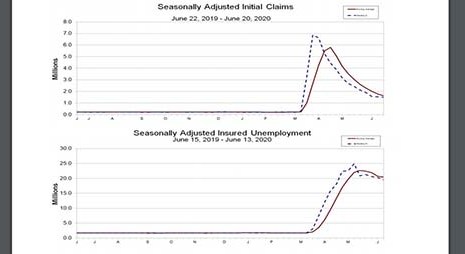

Initial Claims Level Again at 1.5 Million

American workers filed 1.5 million new applications for jobless benefits last weeks, the Labor Department reported Friday—the third consecutive week at that level, but still at historically high levels in the wake of the coronavirus pandemic.

Keith Soura of Blend on the Future of APIs and MISMO

Keith Soura is a Platform Engineer with Blend, San Francisco, responsible for development of Blend’s core platforms, including APIs and event-driven architecture that power customer and partner integrations.

MBA Advocacy Update

Last week, the Consumer Financial Protection Bureau released two Notices of Proposed Rulemaking revising Regulation Z’s QM provisions in response to the scheduled expiration of the GSE Patch on January 10, 2021. The CFPB also issued an Interim Final Rule that will facilitate servicers’ ability to offer streamlined deferral options to borrowers as they exit COVID-19-related forbearance.

21 Years to Save for a Down Payment, Survey Finds

U.S. Mortgage Insurers, an association representing private mortgage insurance companies, said its annual state-by-state report on low down payment mortgage lending found saving for a 20 percent down payment could take potential homebuyers 21 years — three times the length of time it could take to save a 5 percent down payment.

Arend de Jong: Got RODA? Turn Your Customers into an Income-Generating Asset

For years, you took great care to build your list. Clients, and also prospects that didn’t quite become clients yet, but whom you fully intend to make into a client one day. You actually spent quite a bit of money getting the list together. To keep your prized possession whole, you spend quite a bit of time maintaining it. But… have you cracked the code on how to make this pay off for you? Sure: you love returning clients, but are you capitalizing on your list structurally?