MBA: Share of Mortgage Loans in Forbearance Levels Out at 8.55%

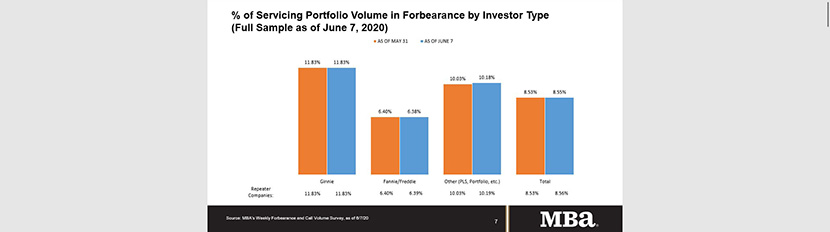

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey said loans now in forbearance increased just slightly, to 8.55% of servicers’ portfolio volume as of June 7 compared to 8.53% the prior week. MBA now estimates 4.3 million homeowners are in forbearance plans.

The movement in the share of loans in forbearance varied by investor type. The share of Fannie Mae and Freddie Mac loans in forbearance dropped by 2 basis points to 6.38%. Ginnie Mae loans in forbearance held steady at a share of 11.83%, while the forbearance share for portfolio loans and private-label securities increased to 10.18%. The percentage of loans in forbearance for depository servicers rose to 9.24%, and the percentage of loans in forbearance for independent mortgage bank servicers increased to 8.43%.

“Results from the first week of June showed a slight uptick in the overall share of loans in forbearance, but this increase was primarily driven by a larger share of portfolio and PLS loans in forbearance,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Half of the servicers in our sample saw the forbearance share decline for at least one investor category. Although there continues to be layoffs, the job market does appear to be improving, and this is likely leading to many borrowers in forbearance deciding to opt out of their plan.”

Fratantoni added with June mortgage payments due, servicers did report the first increase in forbearance requests in two months. “The level of forbearance requests is still quite low, but there was a noticeable increase in call volume over the course of the week,” he said.

Key findings of MBA Forbearance and Call Volume Survey – June 1 – 7

- Total loans in forbearance grew by 2 basis points relative to the prior week: from 8.53% to 8.55%.

- By investor type, the share of Ginnie Mae loans in forbearance remained flat relative to the prior week at 11.83%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 6.40% to 6.38%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance increased relative to the prior week: from 10.03% to 10.18%.

- Forbearance requests as a percent of servicing portfolio volume (#) increased across all investor types for the first time since the week of March 30-April 5: from 0.17% to 0.19%.

- The increase in weekly servicer call center volume was likely driven by beginning-of-month payment inquiries.

- As a percent of servicing portfolio volume (#), calls increased from 6.7% to 8.0%.

- Average speed to answer increased relative to the prior week from 1.6 minutes to 1.8 minutes.

- Abandonment rates increased from 5.2% to 6.0%.

- Average call length decreased from 7.3 minutes to 7.1 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of June 7:

- Total: 8.53% (previous week: 8.55%)

- IMBs: 8.43% (previous week: 8.39%)

- Depositories: 9.24% (previous week: 9.18%)

MBA’s latest Forbearance and Call Volume Survey covers June 1 – 7 and represents 76% of the first-mortgage servicing market (38.2 million loans).