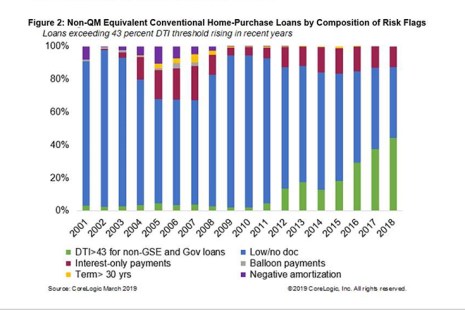

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure.

Category: News and Trends

People in the News

Hines, Houston, promoted Laura Hines-Pierce to Senior Managing Director – Office of the CEO. She will work alongside President and CEO Jeff Hines to help shape firmwide strategy and manage key risks.

MBA Advocacy Update

This past Monday, the House passed two MBA-supported affordable housing proposals that now head to the Senate for consideration. On Friday, the Consumer Financial Protection Bureau announced several important initiatives designed to prevent consumer harm.

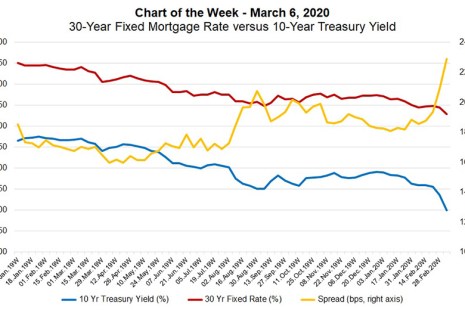

MBA Chart of the Week: 30-Year Fixed Rate vs. 10-Year Treasury

The yield on U.S. 10-year Treasuries fell to record lows last week, driven by increasing concerns regarding the spread of the coronavirus and its impact on the global and U.S. economy. Just last week, there has been an increase in occurrences of business shutdowns, travel restrictions and potential spending reductions.

Tony Taveekanjana: 2020–The Year of the Millennial Homebuyer

Of all generations, millennials represent the single largest buying pool. Yet, across the industry there is a common belief that millennials aren’t interested in buying homes right now. Most lenders attribute this to affordability, high student debt, the appeal of metropolitan life and less loan availability.

Mark P. Dangelo: The Challenges of Reskilling—Part 3

While reskilling initiatives lack the sensationalism of postulating alien radio waves, the innovation predicament caused by continuous innovation cannot be “waved away” by slogans, academics or politicians. Reskilling workforces is likely the largest challenge of the decade facing every banking leader.

MBA Cancels Technology Solutions Conference

The Mortgage Bankers Association canceled its Technology Solutions Conference & Expo in Los Angeles out of concerns stemming from the spreading coronavirus crisis.

MBA Advocacy Update

This past Monday, the House passed two MBA-supported affordable housing proposals that now head to the Senate for consideration. On Friday, the Consumer Financial Protection Bureau announced several important initiatives designed to prevent consumer harm.

MBA, Trade Groups Urge Congress to Ban GSE G-Fee Offsets

The Mortgage Bankers Association and nearly three dozen other industry trade groups, in a Mar. 6 letter to House and Senate leadership, urged Congress to continue to prevent use of Fannie Mae and Freddie Mac guarantee fees as a source of funding offsets.

CFPB Implements Advisory Opinion Program, Amends ‘Responsible Business Conduct’ Bulletin

The Consumer Financial Protection Bureau on Friday announced several Mortgage Bankers Association-recommended steps to offer clear guidance to lenders and servicers.