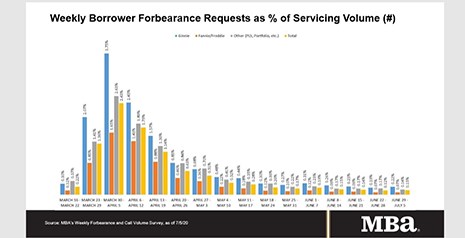

“The share of loans in forbearance continues to decrease, as more workers are brought back from temporary layoffs. However, our survey reveals a notable shift in the location of many FHA and VA loans, which have been bought out of Ginnie Mae pools – predominantly by bank servicers – and moved onto bank balance sheets. As a result, there was a sharp drop in the share of Ginnie Mae loans in forbearance.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.