As Congress returned to begin working on the preliminary contours of another COVID-19 relief and response package, the Federal Housing Finance Agency proposed its 2021 housing goals for Fannie Mae and Freddie Mac, specifying both the single-family and multifamily mortgage purchase benchmarks for low-income borrowers or borrowers residing in low-income areas.

Category: News and Trends

Quote

“Record-low mortgage rates and pent-up demand from the spring continue to be main drivers for the housing market this summer. New home sales picked up for the second straight month in June, in line with various other housing market indicators showing strong demand following the pandemic-induced low in April.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Kelly Hamill and Andrew Foster: Seniors Housing Spotlight

All property types have felt some effects from COVID-19, but seniors housing is a special case. It has seen a variety of impacts including in occupancy rates and expenses.

People in the News July 24, 2020

LRES Corp., Orange, Calif., named Tina Suihkonen as Senior Director of Commercial Services. She will lead LRES’ commercial default services division and provide nationwide commercial trustee and foreclosure services.

Fannie Mae: Explore How the Industry is Going Digital with eMortgages (July 24, 2020)

eMortgages have grown significantly – and in light of recent events, demand is higher than ever. Henry Cason, SVP and Head of Digital Products at Fannie Mae, shares how the industry is embracing digital mortgage solutions. Read our attached blog post for more information.

Steven Octaviano: Today’s Innovation Opportunity–And Why Lenders Must Embrace It

The technologies behind these changes have been with us for some time, but it took a crisis of mammoth proportions to accelerate adoption. Yet there are other areas of the mortgage business still sorely in need of innovation. And if lenders hope to remain competitive and thrive when the smoke from the pandemic clears, they need to be embracing these innovations today.

MBA Education Path to Diversity Scholar Profile: Gabrielle Beck

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

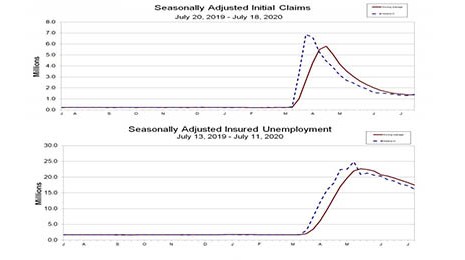

After Several Months of Declines, Insurance Claims Tick Up

Since hitting a record 6.9 million at the end of March, initial claims have fallen, albeit gradually, for the past 15 weeks. That streak ended last week: the Labor Department reported 1.4 million new claims for the week ending July 14, up by 109,000 from the previous week.

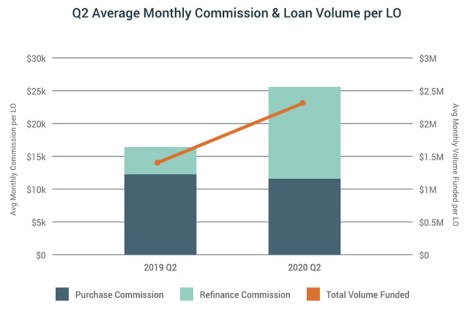

LBA Ware: Surge in Q2 Refinance Volume Nets 59% Increase in LO Commissions

LBA Ware, Macon, Ga., said its quarterly summary of mortgage industry compensation found significant refinance volume growth in the second quarter contributed to a 59% year-over-year increase in total loan originator commissions paid over the three-month period.

Dealmaker: CBRE Global Investors Acquires Two San Jose Office Buildings

A fund sponsored by CBRE Global Investors acquired two Class A office buildings in San Jose, Calif. for $95 million. The buildings, collectively known as 237@First, each span six stories and include 368,702 rentable square feet.