After Several Months of Declines, Insurance Claims Tick Up

Source: Labor Department.

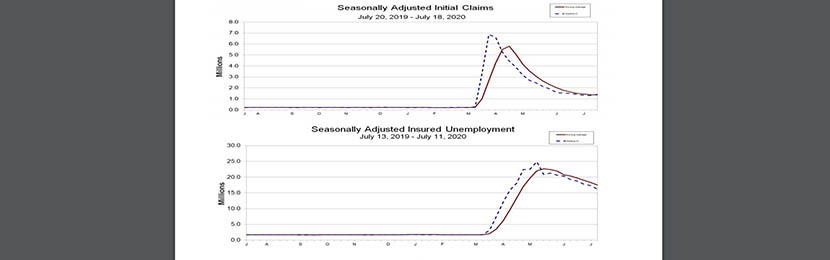

Since hitting a record 6.9 million at the end of March, initial claims have fallen, albeit gradually, for the past 15 weeks. That streak ended last week: the Labor Department reported 1.4 million new claims for the week ending July 14, up by 109,000 from the previous week.

The report marked 18 consecutive weeks of initial claims topping one million, suggesting that the economic fallout from the coronavirus pandemic is not going away, and putting pressure on Congress to come up with a new stimulus package that offers protections to out-of-work Americans; the current package is set to expire July 31.

Labor reported for the week ending July 18, the advance figure for seasonally adjusted initial claims rose to 1,416,000, an increase of 109,000 from the previous week’s revised level. The four-week moving average fell to 1,360,250, a decrease of 16,500 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate—also known as “continuing claims”—fell to 11.1 percent for the week ending July 11, a decrease of 0.7 percentage point from the previous week’s revised rate. The advance number for seasonally adjusted insured unemployment during the week ending July 11 fell to 16,197,000, a decrease of 1,107,000 from the previous week’s revised level. The four-week moving average fell to 17,505,250, a decrease of 758,500 from the previous week’s revised average.

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. said the uptick in claims is “one of the clearest signs” that the economic recovery is stalling. “The renewal in layoffs will turn up the heat on Congress to address the July 31 expiration in emergency unemployment benefits,” she said.

House acknowledged “seasonal factors” could have distorted the topline number this week, as fewer summer shutdowns at auto manufacturers in early July led to a smaller drop in claims mid-month than in recent years. “The 18th consecutive week of initial claims over one million illustrates the relentless nature of the current crisis,” she said. “Currently there are 32 million individuals receiving unemployment benefits through either regular state programs or the Pandemic Unemployment Assistance program, passed under the CARES Act in late March. Congress authorized an additional $600 per week for unemployed workers in the same legislation. It is hard to understate the significance of those transfer payments to household income.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., said the report “highlights that the labor market continues to face significant disruptions” as a direct result of the ongoing COVID-19 pandemic.

“Over the last 18 weeks, nearly 53 million unemployment insurance claims have been filed, and the current initial claims figure is still more than double the highest volume seen during the previous recession,” Duncan said. “The labor market is improving only incrementally and the total extent of joblessness remains unprecedented.”