LBA Ware: Surge in Q2 Refinance Volume Nets 59% Increase in LO Commissions

Chart courtesy of LBA Ware.

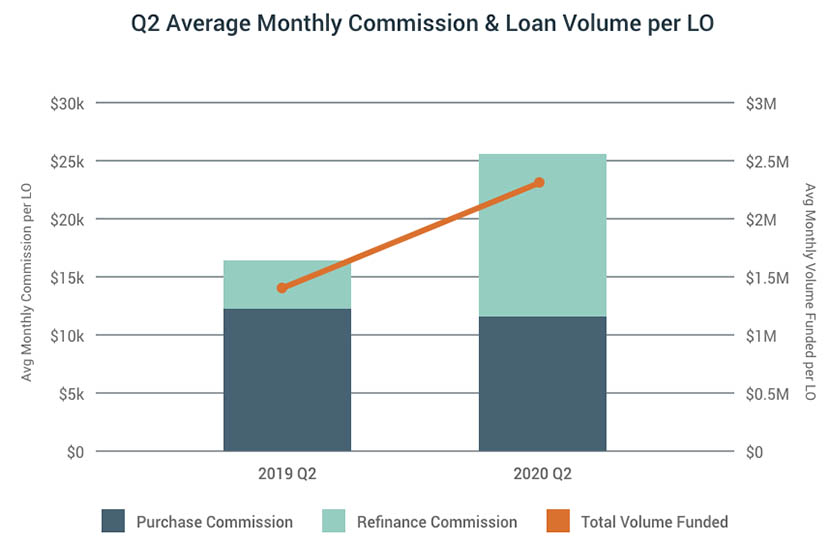

LBA Ware, Macon, Ga., said its quarterly summary of mortgage industry compensation found significant refinance volume growth in the second quarter contributed to a 59% year-over-year increase in total loan originator commissions paid over the three-month period.

The firm’s analysis of data from its CompenSafe ICM platform the average LO originated and funded 63% more volume in the second quarter ($2.4M per month) versus Q2 2019 ($1.4M per month). Other key findings:

–Refinance transactions drove the market in second quarter, accounting for 56% of total volume funded in the quarter (versus only 21% of total volume funded in Q2 2019). LOs averaged $1.4M in funded refinance volume per month, an increase of more than 230% over Q2 2019.

–Although paychecks were larger in Q2 2020 than Q2 2019, the uptick in refinance production contributed to a 2.7% decrease in per-loan commissions from 108 basis points in Q2 2019 to 105 basis points in Q2 2020. Refinance leads are more likely to be company-generated versus self-sourced, so they tend to pay out at a lower rate than purchase loans, averaging 100 basis points in Q2 2020 compared to 110 basis points paid out for purchase loans.

–Purchase volume held steady year-over-year with LOs averaging $1.08M in funded purchase loans per month ($1.16M in Q2 2019) and receiving on average 109.9 basis points per purchase loan (109.7 in Q2 2019).

“In this year of bleak economic news, surging refinance volume and steady home purchase business have been bright spots,” said LBA Ware founder and CEO Lori Brewer. “Low rates have fortified lenders’ pipelines and put more money in originators’ paychecks. LO commissions paid out during the three-month period are up 59% over 2019. I just hope some of that hard-earned money gets set aside for the rainy days that are bound to follow expected increases in unemployment and loan defaults.”