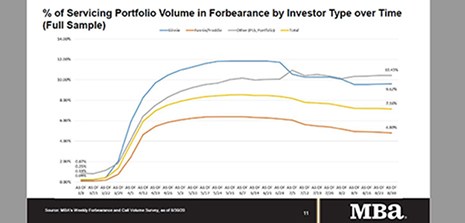

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.

Category: News and Trends

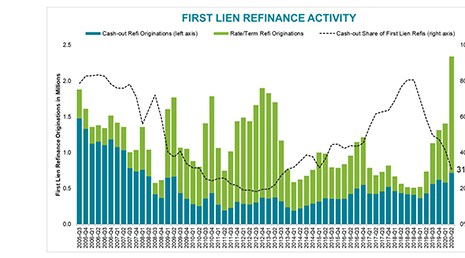

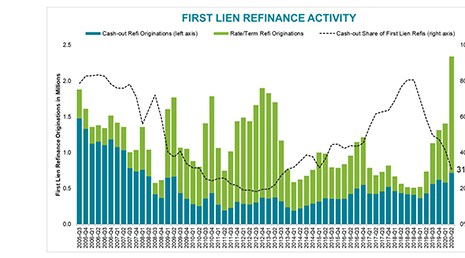

Black Knight: Refi Surge Spurs Record Quarterly Origination Volume

Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.

John Russo: How Loan Officers Can Underwrite Their Own Success

Whether relatively new to the industry or a seasoned mortgage professional, there are some key aspects today’s LOs must consider when searching for a new workplace. In many ways, it is to their benefit to approach it as they would a new potential borrower, as if they were underwriting the company.

Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 4.

A Conversation with SimpleNexus President Cathleen Schreiner Gates

On Tuesday, SimpleNexus, Lehi, Utah, named Cathleen Schreiner Gates as its new President, responsible for all operations and business strategy. MBA NewsLink had the opportunity to talk with her about her new role and the state of the mortgage industry.

Ground-Up Construction Roundup: A Conversation with Key Bank SVP David Drummond and Rabbet CEO Will Mitchell

MBA Newslink interviewed Key Bank Real Estate Capital Senior Vice President David Drummond and Rabbet Chief Executive Officer Will Mitchell about trends and developments in the commercial and multifamily construction sector.

Mortgage Applications Increase in MBA Weekly Survey

Mortgage applications increased 2.9 percent from one week earlier, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending Sept. 4.

MBA: Share of Mortgage Loans in Forbearance Declines to 7.16%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.

Dealmaker: NorthMarq Secures $84M in Fannie Mae, Freddie Mac Financing

NorthMarq, Minneapolis, arranged $83.9 million in Fannie Mae and Freddie Mac financing for apartment properties in Missouri and North Dakota.

Black Knight: Refi Surge Spurs Record Quarterly Origination Volume

Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.