MBA: Share of Mortgage Loans in Forbearance Declines to 7.16%

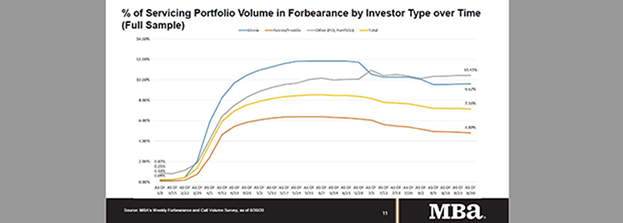

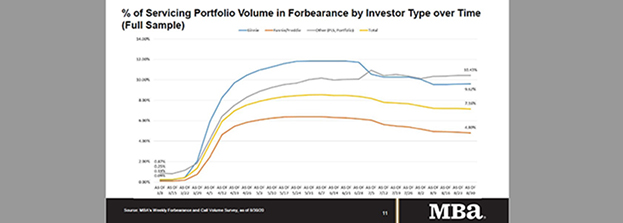

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported the total number of loans now in forbearance decreased 4 basis points to 7.16 percent of servicers’ portfolio volume as of Aug. 30.

According to MBA’s estimate, 3.6 million homeowners are in forbearance plans.The share of Fannie Mae and Freddie Mac loans in forbearance dropped for the 13th week in a row to 4.80 percent – an 8-basis-point improvement. Ginnie Mae loans in forbearance increased by 4 basis points for the second consecutive week to 9.62 percent, while the forbearance share for portfolio loans and private-label securities (PLS) decreased by 1 basis point to 10.43 percent. The percentage of loans in forbearance for depository servicers decreased 9 basis points to 7.40 percent, while the percentage of loans in forbearance for independent mortgage bank (IMB) servicers remained unchanged at 7.41 percent.

MBA Senior Vice President and Chief Economist Mike Fratantoni noted the share of Ginnie Mae loans in forbearance increased again this week, as the current economic crisis continues to disproportionately impact borrowers with FHA and VA loans. As a result, IMB servicers, which have roughly one-third of their portfolio with Ginnie Mae, had a forbearance share that was unchanged, while depositories, which have a larger share of GSE and portfolio loans, saw a decrease.

“The labor market continued to heal in August, with strong job growth and a large decline in the unemployment rate,” said Fratantoni. “However, the economy still faces an uphill climb and remains far away from full employment. High unemployment and jobless claims consistently around 1 million a week, continue to cause financial strain for some borrowers–and especially for those who work in industries hardest hit by the pandemic.”

Key findings of MBA’s Forbearance and Call Volume Survey – August 24 to August 30, 2020:

• Total loans in forbearance decreased by 4 basis points relative to the prior week: from 7.20 percent to 7.16 percent.

o By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior week: from 9.58 percent to 9.62 percent.

o The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior week: from 4.88 percent to 4.80 percent.

o The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior week: from 10.44 percent to 10.43 percent.

• By stage, 35.76 percent of total loans in forbearance are in the initial forbearance plan stage, while 63.29 percent are in a forbearance extension. The remaining 0.94 percent are forbearance re-entries.

• Total weekly forbearance requests as a percent of servicing portfolio volume (#) decreased relative to the prior week: from 0.10 percent to 0.09 percent, the lowest level reported for this series since March.

• Weekly servicer call center volume:

o As a percent of servicing portfolio volume (#), calls remained unchanged at 7.2 percent.

o Average speed to answer increased from 2.2 minutes to 2.4 minutes.

o Abandonment rates increased from 4.9 percent to 5.1 percent.

o Average call length increased from 7.7 minutes to 7.8 minutes.

• Loans in forbearance as a share of servicing portfolio volume (#) as of August 30, 2020:

o Total: 7.16 percent (previous week: 7.20 percent)

o IMBs: 7.41 percent (previous week: 7.41 percent)

o Depositories: 7.40 percent (previous week: 7.49 percent)

MBA’s latest Forbearance and Call Volume Survey covers the period from August 24 through August 30, 2020 and represents 75 percent of the first-mortgage servicing market (37.3 million loans).