Category: News and Trends

Industry Briefs Sept. 21, 2020

ACES Risk Management (ARMCO), Denver, a provider of management and control software for the financial services industry, completed its rebranding effort to align the company’s image with its expanded focus on quality and risk management for banks and credit unions, as well as independent mortgage lenders.

RIHA Study: COVID-19’s Impact on Jobs, Ability to Make Housing, Student Debt Payments

During the first three months of the COVID-19 pandemic, nearly 11 million households fell behind on their rent or mortgage payments and 30 million individuals missed at least one student loan payment, according to new research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Scott Roller: MISMO RON Certification: What You Need to Know

Cute and customized face masks are wildly popular these days, launching a whole new industry. Closer to home, in our industry, popularity of vendors providing for Remote Online Notarization is surging. Thanks to the pandemic, RON vendors were rather unmasked, going from gaining marginal traction to epic growth – overnight. MISMO is leading the way, with a sharp machete clearing the path through the state level regulatory and compliance jungle.

Mark Dangelo: Beyond Digital Transformation Part 2—Challenges of Digital Iterations

While advice and directions concentrate on the “next normal” inflicted by Covid-19, the underlying challenges facing financial services and banking organizations have been building long before its arrival. If banking and mortgage leadership are to adjust to an altered consumer and investment future, they must quickly determine how to build core competencies with digital leveraging—or risk becoming a statistic.

Industry Briefs Sept. 18, 2020

ACES Risk Management (ARMCO), Denver, a provider of management and control software for the financial services industry, completed its rebranding effort to align the company’s image with its expanded focus on quality and risk management for banks and credit unions, as well as independent mortgage lenders.

Housing Report Roundup

Welcome to the Friday Housing Report Roundup. Click on the link to see what’s happening.

Dealmaker: Equity Street Capital JV Acquires Shopping Center for $141M

Equity Street Capital, San Diego, and Big V Property Group, Charlotte, N.C., acquired The Avenue Murfreesboro near Nashville for $141.3 million.

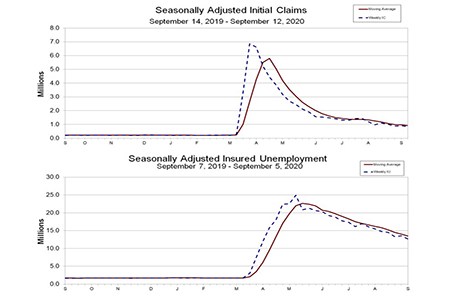

Unemployment Claims Dip to 860,000; Continuing Claims Remain Elevated

The Labor Department yesterday reported 860,000 initial claims for unemployment insurance, seasonally adjusted, for the week ending September 12, down by 33,000 from the previous week, but still high by historical standards.

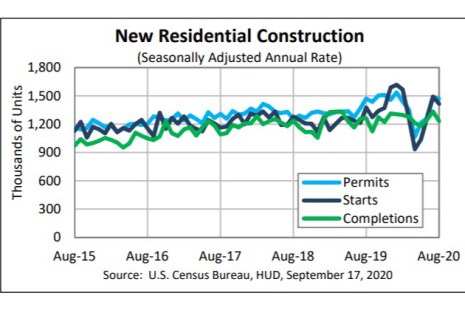

After Strong Summer, August Housing Starts Underwhelm

Housing starts—one of the bright spots in a red-hot summer housing market—faltered in August, HUD and the Census Bureau reported yesterday, although most of the decline took place in multifamily.