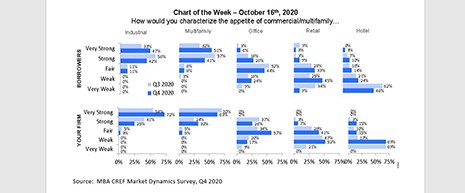

CRE mortgage demand is generally on the rise, with four times more firms expecting borrower demand to be “very strong” in the fourth quarter (24%), compared to the 6% who believed demand was “very strong” in the third quarter.

Category: News and Trends

Dealmaker: Rexford Industrial Acquires Two Industrial Properties For $28M

Real estate investment trust Rexford Industrial Realty, Los Angeles, acquired two southern California industrial properties for $27.6 million and sold three properties for $44.2 million.

Join the Radian Everyday Heroes Challenge, Benefiting the MBA Opens Doors Foundation

This year, as part of the MBA Annual Convention & Expo and ConcertMBA, Radian has launched the Radian Everyday Heroes Challenge, which celebrates the heroes among us who are making a positive impact, while also supporting the MBA Opens Doors Foundation.

Quote

“MBA is the right place for us to draw a line in the sand and say ‘all this bad stuff is going on, it’s not the America any of us thought it would be or want it to be,’ so what can we personally do? Those of us in the mortgage industry can become personally involved in opening doors to homeownership to people who are ready. We just have to say we’ll do it.”

–MBA 2021 Chair Susan Stewart.

MBA Annual20: Training and Education Updates

MBA members looking to advance in their careers and gain industry knowledge will appreciate changes going on with the organizations training and education.

MBA Annual20: Speaker Bios

Here are speakers/bios participating in the Mortgage Bankers Association’s Annual Convention & Expo (Annual20), Oct. 19-21.

MBA Annual Convention Breakout Sessions/Special Events

Breakout sessions are the heart and soul of the Mortgage Bankers Association’s Annual Convention & Expo. These sessions provide in-the-weeds discussions and insights from expert panelists on the most relevant topics to your business in these challenging times.

MBA Annual20 General Sessions: The State of the Industry and Much More

General Sessions have always been the foundation of the MBA Annual Convention & Expo, and this year is no exception. MBA has assembled a stellar lineup of keynote speakers—Administration officials, historians, journalists, sports figures, industry experts—to inform, engage and entertain.

MBA Annual20: Schedule at a Glance

Here is an easy reference schedule for the MBA Annual Convention & Expo, scheduled to take place online Oct. 19-21.

mPower Event at MBA Annual20 with Capricia Marshall Oct. 20

The mPower event, Protocol: The Power of Diplomacy and How to Make it Work for You, takes place Tuesday, October 20 from 3:00-4:00 p.m. ET and features Capricia Marshall, who will share from her best-selling book of the same title and relate why protocol is important in everyone’s day to day lives.