There is plenty of evidence that better borrower satisfaction is a competitive requirement. How will lenders achieve it?

Category: News and Trends

Brian Zitin: Foreshadowing Future Appraisal Bottlenecks During Covid-19

Lenders are seeing record-breaking volume month over month, and it doesn’t seem to be slowing down. One thing that has slowed down across the industry, however, is appraisal turn times. As the volume of loans requiring appraisals goes up, the number of appraisers seems to be going in the opposite direction.

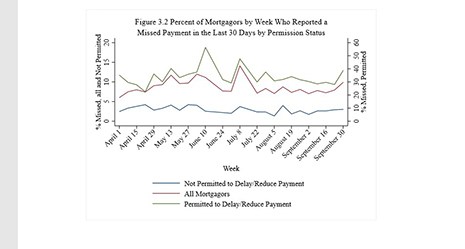

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

Rachael Sokolowski and Rick Triola: Impediments to Interstate Commerce Eliminated by Passage of The Secure Notarization Act

What ever happened to Senate Bill 3533, the Securing and Enabling Commerce Using Remote and Electronic Notarization Act of 2020 (the “SECURE Act”), bipartisan legislation to authorize and establish minimum standards for electronic and remote notarizations (RON), which was introduced in mid-March? We assert that this question would be on more lips and in more headlines had not nearly every state in the Union either adopted its own version of the law or enacted pandemic-necessitated workarounds.

Today at MBA Annual20

Here is an easy reference schedule for the MBA Annual Convention & Expo, scheduled to take place online Oct. 19-21.

Quote

“Time has a huge impact on every transaction. In this world of comparison shopping, the sooner a lender can provide a qualified approval and lock in the rate, the sooner they take the customer off the market. The longer the process drags on, the more likely a customer will slip away.”

–Andrew Weiss, Senior Vice President of Mortgage Origination Platform Strategy with Origence, Irvine, Calif.

Andrew Weiss of Origence on Managing Customer Engagement

Andrew Weiss is Senior Vice President of Mortgage Origination Platform Strategy with Origence, Irvine, Calif., a provider of lending technology and platforms for the financial services industry. He has more than 30 years of experience in the mortgage and consumer lending space and was instrumental in developing Desktop Underwriter while working for Fannie Mae.

The Week Ahead

Good morning and happy Monday! Welcome to the week that Mortgage Bankers Association employees have been waiting for all year: the MBA first-ever virtual Annual Convention & Expo kicks off later this morning via MBA LIVE and runs through Wednesday, Oct. 21.

MBA Advocacy Update Oct. 19, 2020

On Tuesday, MBA submitted comments supporting the Federal Housing Finance Agency’s proposed rule to extend the current GSE affordable housing goals by one year to allow for a better assessment of the economic landscape. In addition, MBA is continuing to work with its state and local partner associations to advocate for extension of work-from-home guidance and “no action” letters permitting state licensed staff to work remotely during the pandemic.

Report Sees Potential Single-Family Rental Headaches

Single-family rental property fundamentals remain healthy, but there could be trouble on the horizon.