“A marked slowdown in forbearance exits, as well as a slight rise in the share of Ginnie Mae, portfolio and PLS loans in forbearance, led to an overall increase for the first time since early June.”

–MBA Chief Economist Mike Fratantoni.

“A marked slowdown in forbearance exits, as well as a slight rise in the share of Ginnie Mae, portfolio and PLS loans in forbearance, led to an overall increase for the first time since early June.”

–MBA Chief Economist Mike Fratantoni.

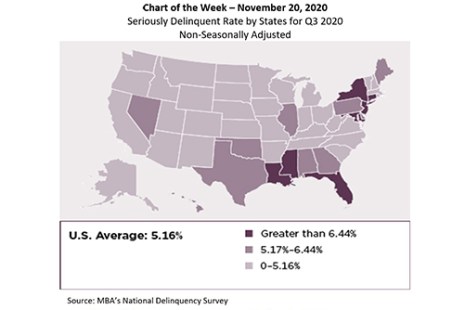

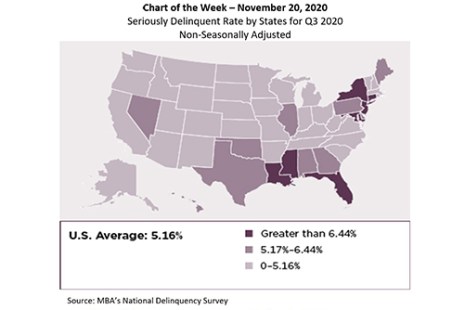

MBA released its National Delinquency Survey results for the third quarter last week. This week’s chart highlights the seriously delinquent rate – the percentage of loans that are 90 days or more delinquent or in the process of foreclosure – in every state across the country.

The shift to digital-first technology has accelerated greatly. Once far on the horizon, digital adoption is no longer an option. Lenders must embrace digital solutions and explore augmented technology to meet consumers where they are and on their own time.

Selling and delivering as a business partner in today’s market, with Nationwide Title Clearing VP of Sales & Marketing, Danny Byrnes.

The MBA Mortgage Action Alliance is accepting nominations for three at-large seats on the 2021-2022 MAA Steering Committee in accordance with the MAA bylaws.

The Mortgage Bankers Association’s annual State of the Association takes place Wednesday, Dec. 2 from 3:00-4:00 p.m. ET. Join MBA President and Chief Executive Officer, Robert D. Broeksmit, CMB, as …

Lenders can reduce the impact of human bias on credit decisioning by building standardized, repeatable and observable processes facilitated by machines. While there’s still value in human interactions, machines are better at ensuring fairness and auditability. You can’t see inside a human mortgage underwriter’s brain, but a computer’s memory leaves a clear trail, making bias easier to measure and safeguard against.

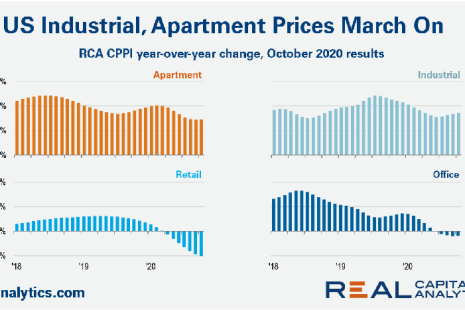

Price gains in the high-flying apartment and industrial sectors offset declining retail and office property prices in October, reported Real Capital Analytics.

Here’s a quick hit on several recent housing and real estate finance reports.

MBA released its National Delinquency Survey results for the third quarter last week. This week’s chart highlights the seriously delinquent rate – the percentage of loans that are 90 days or more delinquent or in the process of foreclosure – in every state across the country.