MBA NewsLink interviewed Bruno Pasceri, President of Incenter LLC and a mortgage industry leader for more than 30 years, about the mortgage banking market and how to navigate future changes.

Category: News and Trends

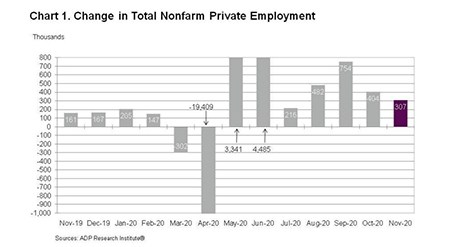

ADP: November Sees 307,000 New Private-Sector Jobs

Ahead of this morning’s weekly Initial Claims report by the Labor Department and Friday’s Employment report by the Bureau of Labor Statistics, ADP, Roseland, N.J., said private-sector employment increased by 307,000 jobs from October to November.

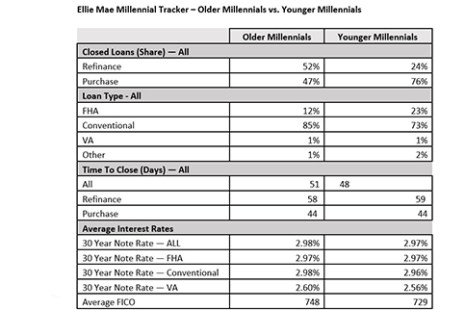

Older, Younger Millennials Diverge on Loan Preferences

With interest rates continuing to hover at historic lows—the Mortgage Bankers Association yesterday pegged the 30-year fixed rate at a record-low 2.92 percent—Millennials appear to be diverging on loan preferences, said Ellie Mae, Pleasanton, Calif.

Dealmaker: Walker & Dunlop Provides $104M for Multifamily

Walker & Dunlop, Bethesda, Md., structured $84.3 million in financing for The Residences at Annapolis Junction, a 416-unit Class A apartment community that delivered in 2018.

Financial Institutions Face Risks To CRE Asset Quality

S&P Global Ratings, New York, said both banks and non-bank financial institutions face risks from their commercial real estate exposure due to the COVID-19 pandemic’s impact on travel, shopping and office usage.

FHFA Extends Foreclosure and REO Eviction Moratoria through Jan. 31

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will extend the moratoriums on single-family foreclosures and real estate owned (REO) evictions until at least January 31, 2021.

Industry Briefs Dec. 3, 2020

ReverseVision, San Diego, updated all documents that reference an index to support both the Constant Maturity Treasury (CMT) and London Interbank Offer Rate (LIBOR) indexes.

FHA Follows Suit, Raises Single-Family Loan Limits for 2021

As expected, the Federal Housing Administration yesterday matched Fannie Mae and Freddie Mac in its single-family and Home Equity Conversion Mortgage insurance programs for 2021.

MBA Mortgage Action Alliance Steering Committee Elections Open through Dec. 9

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, is holding elections for three at-large seats on its 2021-2022 MAA Steering Committee. The active voting period will be open until Wednesday, Dec. 9 at 5:00 p.m. ET.

Mortgage Applications Dip Slightly in MBA Weekly Survey

Despite sustained record-low interest rates, mortgage applications dipped slightly during the holiday-shortened Thanksgiving week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 27.