As the CARES Act has been welcome relief to borrowers, many servicers are finding their own relief in strategic partnerships.

Category: News and Trends

Bruno Pasceri: The Transformation Ahead

MBA NewsLink interviewed Bruno Pasceri, President of Incenter LLC and a mortgage industry leader for more than 30 years, about the mortgage banking market and how to navigate future changes.

MBA Mortgage Action Alliance Steering Committee Elections Open through Dec. 9

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, is holding elections for three at-large seats on its 2021-2022 MAA Steering Committee. The active voting period will be open until Wednesday, Dec. 9 at 5:00 p.m. ET.

MBA Advocacy Update–Dec. 7, 2020

Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell testified last week before House and Senate committees providing an update on CARES Act oversight. In both hearings, Mnuchin addressed the future of the GSEs, and stressed that they should not be released from conservatorship until each has sufficient capital.

People in the News Dec. 7, 2020

Cherry Creek Mortgage, Denver, appointed Rick Seehausen to president and COO of Cherry Creek Holdings, where he will oversee all company operations, including IT, human resources, legal, accounting, marketing and compliance divisions.

The Week Ahead—Dec. 7, 2020

The MBA virtual Accounting & Financial Management Conference 2020 is ready to go, taking place online this Wednesday, Dec. 9 and Thursday, Dec. 10. The conference brings together leading authorities in real estate finance to share critical business intelligence, insights and best practices on evolving accounting, regulatory and financial management issues.

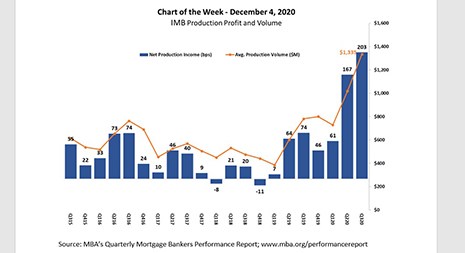

MBA Chart of the Week: IMB Production Profit and Volume

MBA released its latest Quarterly Performance Report for the third quarter last week. Independent mortgage banks and mortgage subsidiaries of chartered banks reported study-high average pre-tax production profits of 203 basis points ($5,535 on each loan originated) in the third quarter, up from 167 basis points ($4,548 per loan) in the second quarter.

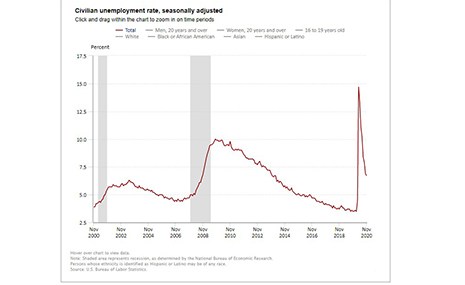

Job Growth Slows Heading into Uncertain Winter

Total nonfarm payroll employment growth slowed to 245,000 in November, the Bureau of Labor Statistics reported Friday, with nearly 10 million fewer jobs currently compared to a year ago.

REIT Outlook Negative, But Improving

The 2021 rating outlook for U.S. real estate investment trusts remains negative, but Fitch Ratings, New York, said its outlook for the sector is improving.

Dealmaker: Meridian Capital Group Arranges $78M for Multifamily, Office

Meridian Capital Group, New York, arranged $77.5 million to construct a New York multifamily property and refinance a Norwalk, Conn. office property.