We take a closer look at decision intelligence and why mortgage executives are prioritizing this new concept in their business operations.

Category: News and Trends

CRE Performance, Outlook Varies by Bucket

Investors and lenders are grouping commercial properties into distinct “buckets,” and different buckets will likely perform differently as the economy bounces back from the Pandemic Recession, said MBA Vice President of CRE Research & Economics Jamie Woodwell.

MBA Opens Doors Foundation Receives $1 Million Donation from Fairway Independent Mortgage Corp.

The MBA Opens Doors Foundation announced it received a $1 million gift from Fairway Independent Mortgage Corp. – the largest donation received in the foundation’s 10-year history.

MBA Comment Letter Asks Level Playing Field on Consumer Access to Financial Records

The Mortgage Bankers Association submitted a comment letter yesterday to the Consumer Financial Protection Bureau, asking that a Bureau proposal on consumer access to financial records provide a level playing field for all authorized data users and promotes consumer awareness in the ways that data are accessed and used.

MBA Presents UBS with Commercial/Multifamily Diversity and Inclusion Leadership Award

The Mortgage Bankers Association presented UBS with the 2021 Commercial/Multifamily Diversity and Inclusion Leadership Award.

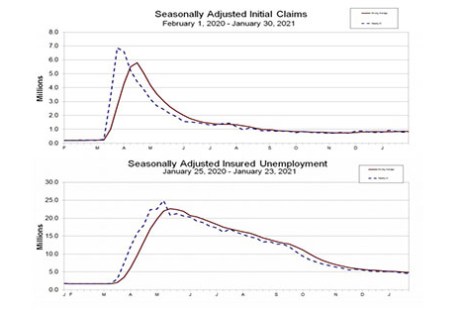

Initial Claims Show Improving Trend

Initial claims for unemployment insurance fell for the third straight week to their lowest level since November, the Labor Department reported yesterday, signaling the economy could be heading toward more stable footing.

Dealmaker: Pacific Southwest Realty Services Closes $95M

Pacific Southwest Realty Services, San Diego, closed $95 million for a medical office building portfolio and an industrial center.

Addressing America’s Affordability Crisis

Moody’s Analytics and the Urban Institute recently reported that more than 10 million U.S. renter households owe more than $5000 in back rent and fees as America’s affordability problem worsens during the pandemic. Analysts took on these and other issues in a lively session at the Mortgage Bankers Association’s CREF21 virtual convention.

Dealmaker: Mesa West Capital Funds $59M Loan for Silicon Valley Office Building

Mesa West Capital, Los Angeles, provided a $58.7 million first mortgage to a joint venture between Goldman Sachs’ Merchant Banking Division and Lincoln Property Co. for a Mountain View, Calif. office building.

Troubled Commercial Mortgage Loan Triage: A Special Servicer Roundtable

With the ebb and flow of 2020 market disruption in the rearview mirror and the vaccine rollout in full swing, MBA NewsLink checked in with a special servicer, a rating agency servicer analyst and Freddie Mac asset management chief to explore what is happening in commercial/multifamily markets, where different parts of the commercial real estate finance ecosystem are today and factors driving the outlook for agency and non-agency CMBS sectors.