Initial Claims Show Improving Trend

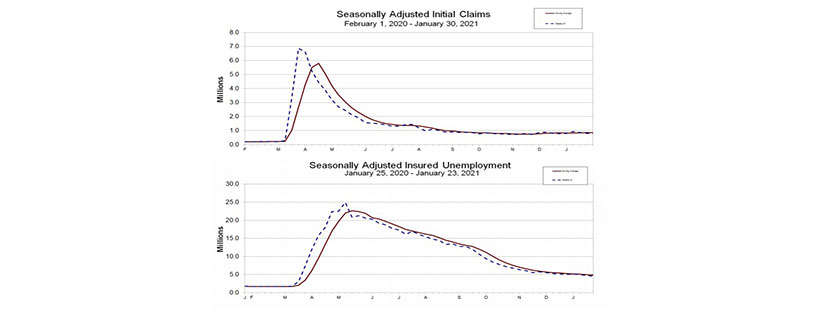

(Chart courtesy U.S. Department of Labor.)

Initial claims for unemployment insurance fell for the third straight week to their lowest level since November, the Labor Department reported yesterday, signaling the economy could be heading toward more stable footing.

The report said for the week ending January 30, the advance figure for seasonally adjusted initial claims fell to 779,000, a decrease of 33,000 from the previous week’s level, which revised down by 35,000 from 847,000 to 812,000. The four-week moving average fell to 848,250, a decrease of 1,250 from the previous week’s average, which revised down by 18,500 from 868,000 to 849,500.

The advance seasonally adjusted insured unemployment rate fell to 3.2 percent for the week ending January 23, a decrease of 0.2 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending January 23—also known as continuing claims—fell to 4,592,000, a decrease of 193,000 from the previous week’s level, which revised up 14,000 from 4,771,000 to 4,785,000. The four-week moving average fell 4,881,750, a decrease of 120,000 from the previous week’s average, which revised up by 3,750 from 4,998,000 to 5,001,750.

Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said while jobless claims remain elevated by historical standards, this week’s report suggests a more positive trend.

“The 33,000 drop in jobless claims to a nine-week low of 779,000 adds to the evidence that the labor market’s recovery is getting back on track,” House said. “[Friday’s] jobs report is likely to further suggest that the worst of the winter-slowdown may already be behind us.”

House noted as data move further away from the volatility surrounding the end-of-year holidays, the trend is becoming clearer: the pace of layoffs is easing once again, noting claims under the Pandemic Unemployment Assistance program fell by 55,000 to 349,000. “While that suggests some unemployed persons may be getting back to work, some of the decline may also be symptomatic of gaps in coverage surrounding programs being extended at the last minute in December,” she said.

“The decline in new claims in recent weeks adds to the evidence that the worst months for the labor market could very well be behind us,” House added. “Hiring picked up more than expected in January according to the ISM surveys and ADP reports, while job postings according to Opportunity Insights also turned higher in January. Vaccinations have been gathering pace and more fiscal support has started to find its way into the economy, with likely more to come.”

Nevertheless, House said Friday’s employment report is likely to show that the labor market remains in a delicate position. “However, considering the backdrop of the weeks leading up to the survey—record hospitalizations, ongoing restrictions and uncertainty that another major relief package would make it across the finish line—a resumption in hiring would show the recovery is getting back on track,” she said.

The Bureau of Labor Statistics releases its Employment report this morning at 8:30 a.m. ET. MBA NewsLink will provide coverage in the Monday, Feb. 8 edition, with analysis from MBA Chief Economist Mike Fratantoni and others.