MBA recognizes its Select Associate Members and thanks them for their continued support of MBA and the real estate finance industry.

Category: News and Trends

MBA, Coalition Urge Homeowner Relief in COVID-19 Package

The Mortgage Bankers Association and nearly 300 other industry trade groups and community organizations urged Congress to include direct assistance to homeowners with COVID-19 hardships in any upcoming economic stimulus package.

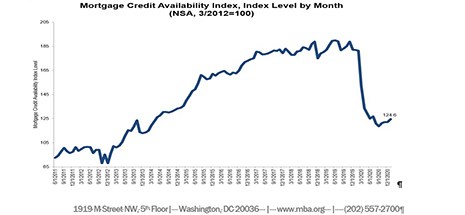

January Mortgage Credit Availability Increases

Mortgage credit availability increased in January, the Mortgage Bankers Association reported this morning.

MBA Recognizes Premier Members

MBA is proud to recognize its Premier and Select Associate Members and to thank them for their continued support of MBA and the real estate finance industry.

Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

MISMO Implements Innovation Investment Fee

MISMO, the industry standards organization, has instituted a $0.75 per loan Innovation Investment Fee.

Quote

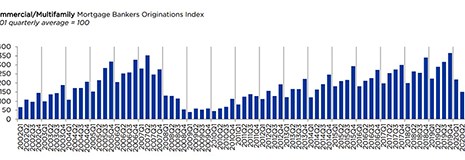

“The steep declines in mortgage borrowing and lending seen in 2020 should partially reverse in 2021. The economic rebound MBA anticipates in the second half of the year should bring greater stability to the markets, but with continued differentiation by property type. Much of the path forward will depend on the virus and our confidence and ability to move past it.”

–Jamie Woodwell, MBA Vice President for Commercial Real Estate Research.

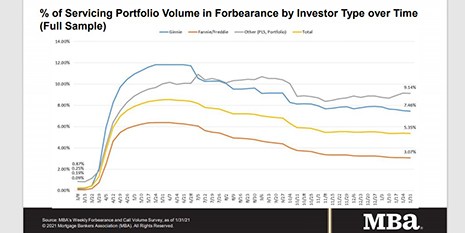

MBA: Loans in Forbearance Fall to 5.35%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 3 basis points to 5.35% of servicers’ portfolio volume as of Jan. 31 compared to 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: 4th Quarter Commercial/Multifamily Borrowing Falls 18 Percent

Commercial and multifamily mortgage loan originations fell by 18 percent in the fourth quarter from a year ago, but increased by 76 percent from the third quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Adam Batayeh: What Mortgage Lenders Can Learn from Tesla

Historically a cyclical business, mortgage lending has experienced substantial increases in volume, forcing lenders to throttle up their efforts, but those without an intelligent Loan Manufacturing (iLM) plan have been left with more challenges.