Nick Volpe: Managing Effects of Changing Regulations on Mortgage Servicing Operations

Nick Volpe is executive vice president of account management with ACES Quality Management, Denver. Reach him at nvolpe@acesquality.com.

When it comes to COVID-19’s impact on the finance industry, the devil is in the details. A look at post-closing quality control data from the second quarter of 2020 reveals another spike in early payment defaults without a clear end in sight. Having increased by nearly 200% compared to pre-pandemic levels, EPDs are also 50% higher than the prior quarter. As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

While EPDs are expected to level off in the near future, uncertainty is still looming. Their correlation to the CARES Act forbearances is unknown, as well as exactly how other wild-card factors, like expiring extended unemployment benefits, additional stimulus programs and recovery in unemployment will play into the rate of EPDs. A large portion of the initial 6-month CARES Act forbearances expired and were then extended for another 6-months, and the industry awaits further response from the Agencies on whether or not all EPDs will be evaluated for repurchase.

According to data from the previous quarter, roughly 70% of initial forbearance plans were in an extension status, which sparked concern about the downstream burden on servicers. The pandemic accelerated the pace of new regulations for servicers, and oversight and QC requirements are notoriously less refined than those for origination quality control. Pivoting on a moment’s notice, for many servicers, has proven to be a difficult task.

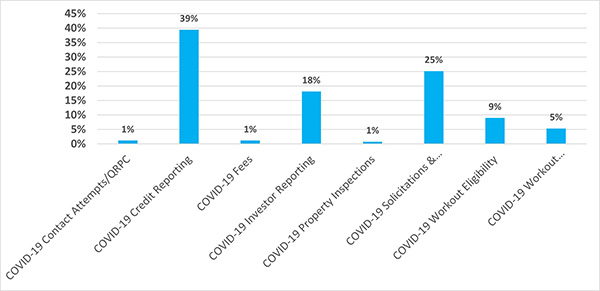

In analyzing COVID-focused reviews through November 1, 2020, nearly 40% of exceptions related to the pandemic were cited for inaccurate credit reporting, according to data presented in ACES’ latest QC Now Webinar. This data mirrors the CFPB’s Consumer Complaint data, with 203,137 total complaints related to credit reporting submitted between March 31, 2020 and December 1, 2020.

COVID-RELATED DEFECTS: SERVICING

The credit reporting issues included a CARES Act guideline requiring that borrowers not delinquent prior to being granted a COVID-19 payment accommodation be reported as current for the duration of the accommodation. This also includes borrowers that were delinquent prior to the accommodation. In this case, servicers are required to ensure that the borrowers’ delinquency did not advance throughout the payment accommodation period. Reporting status’ to the credit bureaus is a highly automated process for most servicers

Many of the top cited issues were driven by automation in the servicing system. Servicers do not manually send info to credit bureaus or distribute mass compliance notices using mail room personnel. Tasks are mainly driven by status codes in the system enabling downstream automation that are programmed from scratch with scripts that must account for a number of different scenarios. System-driven by nature, ample time is required to implement such changes, and with requirements changing so rapidly, servicers simply did not have time to prepare and although they worked quickly to adjust systems, many of the kinks have yet to be fully worked out.

The operational and compliance burden placed on servicers as a result of the pandemic closely resembles that of the 2009 financial crisis and the following years, when loan modifications and foreclosure look back reviews skyrocketed. Though the hot topics at the time were Single Point of Contact and Dual Pathing, the pace of new requirements and bursting volume are strikingly similar. Servicers created specialized teams to become experts on modifications and the compliance items to avoid borrower harm and protect the servicer. QA and QC plans were also created to serve as a compliance backstop to those specialized teams, which may be useful for servicers to consider in dealing with a similar situation.

Moving forward, it’s essential that servicers train on the specific requirements and servicing responsibilities of the CARES Act in order to establish comprehensive policies and procedures. Any personnel speaking to borrowers should possess a solid understanding of the requirements – including those that do not impact their specific area of responsibility.

Servicers should also ensure they have exception reporting at the ready to acknowledge automation blind spots. Stemming from illogical conditions in the servicing system, exception reports should drive targeted sampling for the compliance and QC departments. Gaining visibility into the testing results at the highest levels of the organization can help drive key operational, process and technology changes.

Without a definitive answer of exactly when the rate of new regulations will slow, servicers’ best course of action is to be well-versed on the CARES Act requirements to ensure compliance. With the proper policies, procedures and tools in place, loan servicers are better equipped to tackle servicing QC challenges while keeping pace with ever-changing regulatory requirements.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)