Purchase applications rose, but a sharp drop in refinance applications led to an overall drop in mortgage applications last week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 21.

Category: News and Trends

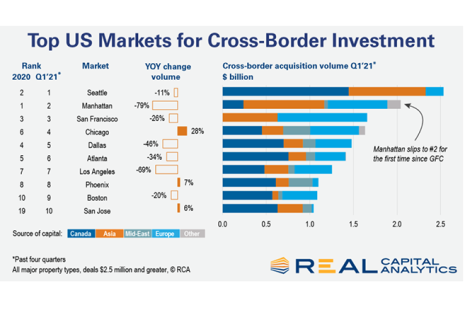

Seattle Eclipses Manhattan as Top Market for Cross-Border Buyers

Seattle surpassed Manhattan to become the leading U.S. market for cross-border investment, reported Real Capital Analytics, New York.

Dealmaker: Meridian Capital Group Arranges $172M for One Museum Square

Meridian Capital Group, New York, arranged $171.6 million to refinance newly constructed multifamily property One Museum Square in Los Angeles, on behalf of JH Snyder Co., Los Angeles.

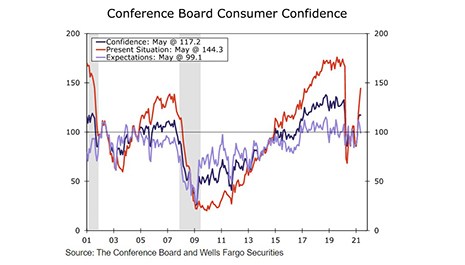

May Consumer Confidence Holds Steady

The Conference Board, New York, reported its monthly Consumer Confidence Index held steady in May, following a gain in April. The Index now stands at 117.2, down marginally from 117.5 in April.

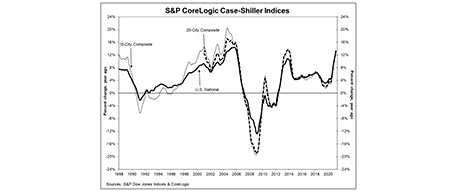

Home Prices Maintain Robust Pace

Home prices continued to post double-digit annual gains amid a red-hot spring housing market, according to the Standard & Poor’s CoreLogic Case-Shiller Indices.

New Home Sales Tumble to 10-Month Low

New home sales took a double hit yesterday, according to HUD and the Census Bureau: not only did April new home sales fall by nearly 6 percent, March sales revised sharply downward by more than 10 percent.

Jim Rosen: Why Now is the Time for eClosings

When it comes to closing, there are lots of moving parts involved that have traditionally been in person or on physical paper. However, things had to change rapidly. Although a challenge in the beginning, it has also presented a large opportunity and given borrowers and lenders more flexibility in how they complete tasks.

MBA CONVERGENCE Partner Profile: Pete Carroll, CoreLogic

Pete Carroll is executive of Public Policy & Industry Relations with CoreLogic, Irvine, Calif., and a member of the CONVERGENCE Memphis Steering Committee.

Quote

“The rising inventory of homes not yet started likely reflects efforts by builders to wait for the supply of lumber and other building materials to catch back up with demand.”

–Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C.

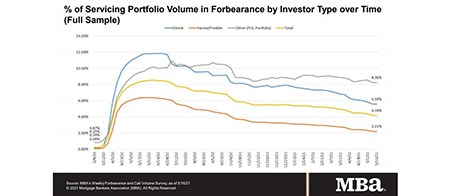

MBA: Share of Mortgage Loans in Forbearance Decreases to 4.19%

Mortgage loans in forbearance fell for the 12th consecutive week, the Mortgage Bankers Association reported Monday.