Institutional Property Advisors, Calabasas, Calif., closed multifamily property sales totaling $173 million in California and Connecticut.

Category: News and Trends

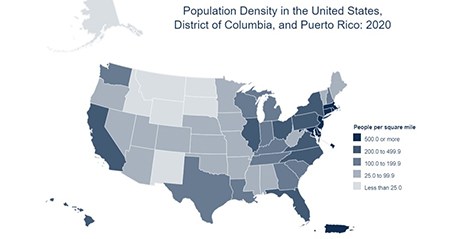

The New Census Figures: a Breakdown

The Census Bureau last week released preliminary results from its 2020 Census, showing a United States in the midst of demographic transition.

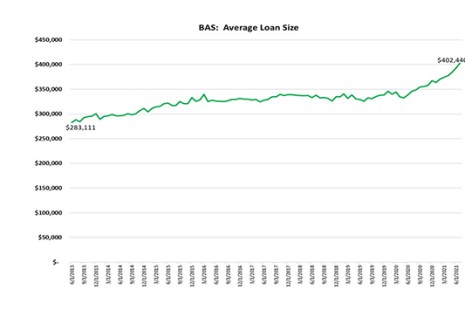

July New Home Purchase Mortgage Applications Down from June

Mortgage applications for new home purchases decreased 27.4 percent compared to a year ago, the Mortgage Bankers Association Builder Application Survey reported.

Quote

“While new home purchase activity is still robust, rising home prices are potentially pricing some borrowers out of the housing market. These rising home values have driven mortgage balances to record highs. We expect origination volumes to remain healthy.”

–Joe Mellman, senior vice president and mortgage business leader with TransUnion, Chicago.

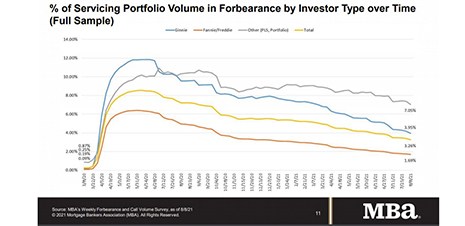

Share of Mortgage Loans in Forbearance Decreases to 3.26%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

Industry Briefs Aug. 18, 2021

The Federal Housing Finance Agency released reports providing the results of the 2020 and 2021 annual stress tests Fannie Mae and Freddie Mac under the Dodd-Frank Act.

Mark P. Dangelo: The Dark Matter Transforming M&A Post-Deal Landscapes, Part 2

M&A events in the Age of Industry 4.0 have moved beyond scale and into the digital clarity achieved by the combination of firms using curated data necessary to profit from vast ecosystems of financial products and services across channels and consumers. Financial and private equity firms that target and conduct due diligence solely on financial engineering will become footnotes in history.

MBA CONVERGENCE Partner Profile: Sarah Garland of CBRE

Sarah Garland is Director of Production for Affordable Housing and FHA Lending with CBRE, Seattle, responsible for supporting the origination of affordable and workforce housing debt financing.

People in the News August 17 2021

The Greater Omaha Chamber of Commerce will induct former Mortgage Bankers Association Chairman Rodrigo López, CMB, into its Omaha Business Hall of Fame at a ceremony later this month.

Rita Moreno Keynotes mPower Luncheon at MBA Annual Convention & Expo

Registration for the Mortgage Bankers Association’s Annual Convention & Expo, taking place Oct. 17-20 at the San Diego Convention Center, is officially open. Join MBA in San Diego as Academy Award- and Presidential Medal of Freedom Award-winning actress Rita Moreno keynotes the mPower Luncheon on Tuesday, Oct. 19.