MBA: Commercial, Multifamily Delinquencies Continue Downward Trend

Delinquency rates of mortgages backed by commercial and multifamily properties have broadly improved in recent months, according to two new Mortgage Bankers Association reports.

The findings come from MBA’s new Commercial Real Estate Finance Loan Performance Survey for August and the latest quarterly Commercial/Multifamily Delinquency Report for the second quarter. MBA developed the CREF Loan Performance Survey to better understand the ways pandemic is–and is not–affecting commercial mortgage loan performance. The MBA Commercial/Multifamily Delinquency Report’s regular quarterly analysis of commercial/multifamily delinquency rates uses third-party numbers to cover each of the major capital sources.

“Delinquency rates for mortgages backed by commercial and multifamily properties have broadly improved in recent months as the U.S. economy continues to heal from the COVID-19 pandemic,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “Performance is still property-type dependent, with the properties that saw the most immediate and dramatic impacts from the pandemic–lodging and retail–still experiencing considerably more stress than others but showing improvement. Delinquency rates are down significantly for those property types and remain muted for others.”

Woodwell noted he expects continued downward pressure on delinquency rates as more later-stage delinquencies are worked through. “What happens with early-stage delinquencies will largely be a function of the broader economy,” he said.

Key Findings from MBA’s CREF Loan Performance Survey for August:

Note: The survey includes a range of delinquency measures, but for the purposes of understanding the impacts from the pandemic, any non-current loan is generally treated as delinquent).

The balance of commercial and multifamily mortgages that are not current declined in August.

- 96.6% of outstanding loan balances were current, up from 95.5% a month earlier.

- 2.2% were 90-plus days delinquent or in REO, down from 2.9% a month earlier.

- 0.2% were 60-90 days delinquent, unchanged from a month earlier.

- 0.3% were 30-60 days delinquent, unchanged from a month earlier.

- 0.8% were less than 30 days delinquent, down from 1.1% a month earlier.

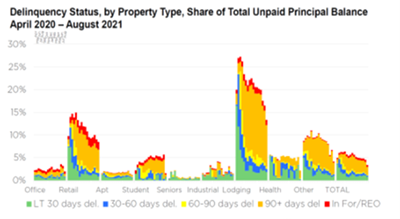

Loans backed by lodging and retail properties continue to see the greatest stress, but also saw improvement.

- 13.4% of the balance of lodging loans were delinquent, down from 16.5% a month earlier. 8.5% of the balance of retail loan balances were delinquent, down from 9.0% a month earlier.

- Non-current rates for other property types were at lower levels during the month:

- 1.5% of the balances of industrial property loans were non-current, down from 1.8% a month earlier.

- 2.0% of the balances of office property loans were non-current, down from 3.2% a month earlier.

- 1.2% of multifamily balances were non-current, down from 1.5% a month earlier.

Because of the concentration of hotel and retail loans, commercial mortgage-backed securities loan delinquency rates are higher than other capital sources.

- 6.9% of CMBS loan balances were non-current, down from 8.2% a month earlier.

- Non-current rates for other capital sources were more moderate.

- 2.0% of FHA multifamily and health care loan balances were non-current, down from 2.8% a month earlier.

- 1.9% of life company loan balances were non-current, up from 1.7% from a month earlier.

- 0.6% of GSE loan balances were non-current, down from 0.9% a month earlier.

Click here for more information onMBA’s CREF Loan Performance Survey for August.

Key Findings from MBA’s Second Quarter Commercial/Multifamily Delinquency Report:

Note: MBA’s quarterly report relies on the headline delinquency measures used by each capital source. Each capital source’s measure is different. The different measures can give a good indication of delinquency trends within a source but should not be used to compare any one capital source to another.

Commercial and multifamily mortgage delinquencies declined in the second quarter.

- Banks and thrifts (90 or more days delinquent or in non-accrual): 0.75%, a decrease of 0.05 percentage points from the first quarter;

- Life company portfolios (60 or more days delinquent): 0.05%, a decrease of 0.05 percentage points from the first quarter;

- Fannie Mae (60 or more days delinquent): 0.53%, a decrease of 0.13 percentage points from the first quarter;

- Freddie Mac (60 or more days delinquent): 0.15%, a decrease of 0.02 percentage points from the first quarter; and

- CMBS (30 or more days delinquent or in REO): 5.68%, a decrease of 0.58 percentage points from the first quarter.

MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another.

Differences between the delinquencies measures are detailed in Appendix A. Click here to view the report.