“We continue to expect weakening refinance activity as rates move higher and borrowers see less of a rate incentive.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

“We continue to expect weakening refinance activity as rates move higher and borrowers see less of a rate incentive.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

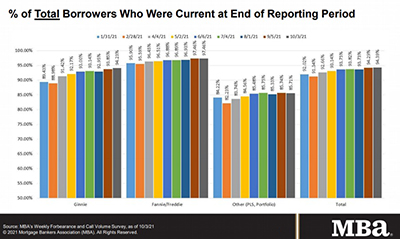

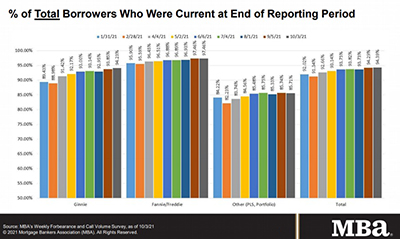

Mortgage borrowers exited forbearance at the fastest rate in more than a year, the Mortgage Bankers Association reported Monday.

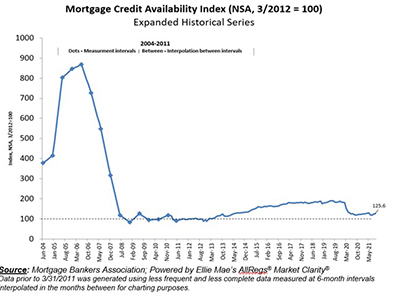

Mortgage credit availability increased for the third straight month in September to its highest level in five months, the Mortgage Bankers Association reported Tuesday.

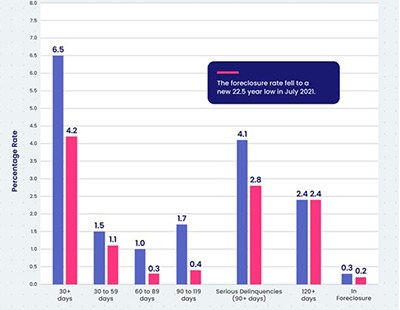

CoreLogic, Irvine, Calif., said delinquency rates on all mortgages in the U.S. fell in July to the lowest rates since March, edging closer to pre-pandemic levels.

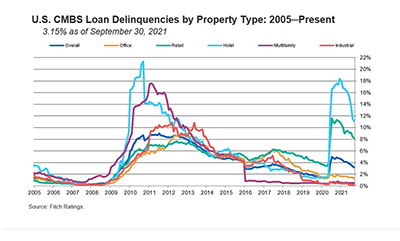

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

We must remember to encourage people to buy homes they can afford and educate them on the costs that go with owning a home. That includes advising consumers not to borrow as much money as they possibly can, lest they become “house poor” and miss out on being able to create a more financially secure future for themselves and their families.

Mortgage borrowers exited forbearance at the fastest rate in more than a year, the Mortgage Bankers Association reported Monday.

Marcus & Millichap, Calabasas, Calif. closed $180.6 million in Florida and New York industrial and multifamily property sales.

Black Knight delivers innovative integrated solutions for every step in the real estate and mortgage process.

mPowering You, MBA’s Summit for Women in Real Estate Finance, takes place Saturday, Oct. 16 at the San Diego Convention Center just ahead of the MBA Annual Convention & Expo (Oct. 17-20).