Share of Mortgage Loans in Forbearance Decreases to 2.62%

Mortgage borrowers exited forbearance at the fastest rate in more than a year, the Mortgage Bankers Association reported Monday.

The MBA Forbearance and Call Volume Survey reported loans now in forbearance decreased by 27 basis points to 2.62% of servicers’ portfolio volume as of Oct. 3 from 2.89% the prior week. MBA estimates 1.3 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased by 17 basis points to 1.21%. Ginnie Mae loans in forbearance decreased 41 basis points to 2.94%, while the forbearance share for portfolio loans and private-label securities declined by 35 basis points to 6.42%. The percentage of loans in forbearance for independent mortgage bank servicers decreased 37 basis points from the prior week to 2.82%, while the percentage of loans in forbearance for depository servicers decreased 24 basis points to 2.69%.

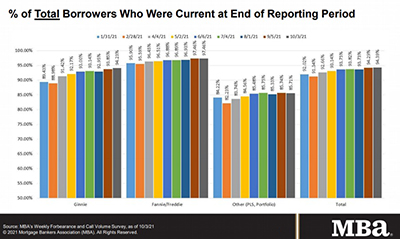

“Many borrowers reached the expiration of their forbearance term as we entered October,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Payment performance has remained steady for those who have exited forbearance and into a workout since 2020, with more than 85% of those borrowers current as of October. It also continues to be striking that so many homeowners in forbearance have continued to make their payments. Almost 16 percent of borrowers in forbearance as of October 3rd were current.”

Fratantoni noted job growth was weaker than expected in September, reflecting the challenges from

the Delta variant, ongoing supply-chain issue, and resulting slowdowns in workplace and school re-openings. “However, the drop in the unemployment rate, rising wages, and abundant job openings will continue to help support the housing market, including helping borrowers exit forbearance successfully in the weeks ahead,” he said.

Key findings of MBA’s Forbearance and Call Volume Survey – September 27 – October 3

• Total loans in forbearance decreased by 27 basis points from 2.89% to 2.62%.

o By investor type, the share of Ginnie Mae loans in forbearance decreased from 3.35% to 2.94%.

o The share of Fannie Mae and Freddie Mac loans in forbearance decreased from 1.38% to 1.21%.

o The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased from 6.77% to 6.42%.

• By stage, 13.3% of total loans in forbearance are in the initial forbearance plan stage, while 77.5% are in a forbearance extension. The remaining 9.2% are forbearance re-entries.

• Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased from 0.04% to 0.05%.

• Of the cumulative forbearance exits for the period from June 1, 2020, through October 3, 2021, at the time of forbearance exit:

o 28.8% resulted in a loan deferral/partial claim.

o 21.3% represented borrowers who continued to make their monthly payments during their forbearance period.

o 16.5% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

o 12.6% resulted in a loan modification or trial loan modification.

o 12.3% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

o 7.2% resulted in loans paid off through either a refinance or by selling the home.

o The remaining 1.4% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

• Weekly servicer call center volume:

o As a percent of servicing portfolio volume (#), calls increased from 5.9% to 7.8%.

o Average speed to answer increased from 1.5 minutes to 2.5 minutes.

o Abandonment rates increased from 4.2% to 6.2%.

o Average call length increased from 8.2 minutes to 8.4 minutes.

• Loans in forbearance as a share of servicing portfolio volume (#) as of October 3:

o Total: 2.62% (previous week: 2.89%)

o IMBs: 2.82% (previous week: 3.19%)

o Depositories: 2.69% (previous week: 2.93%)

MBA’s latest Forbearance and Call Volume Survey represents 73% of the first-mortgage servicing market (36.5 million loans). To subscribe to the full report, go to www.mba.org/fbsurvey.

If you are a mortgage servicer interested in participating in the survey, email fbsurvey@mba.org.