Gershman Investment Corp., St. Louis, Mo., closed a $33.7 million HUD 221(d)4 loan for Heartland View Apartments in Wentzville, Mo.

Category: News and Trends

MISMO Seeks Public Comment on New Mortgage Insurance Estimated Rate Quote Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on its new implementation guide specification that helps facilitate obtaining estimated mortgage insurance rate quotes in the JavaScript Object Notation API format.

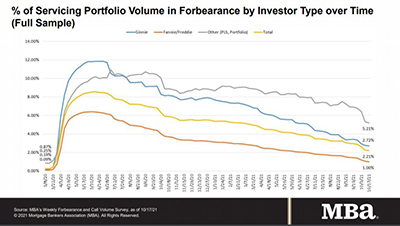

Share of Mortgage Loans in Forbearance Decreases to 2.21%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 2.21% of servicers’ portfolio volume as of October 17 from 2.28% the week before. MBA estimates 1.1 million homeowners are in forbearance plans.

MORPAC Honors Paul Walnick with the 2021 Schumacher-Bolduc Award

The Mortgage Bankers Association Political Action Committee awarded Paul Walnick, President of Business Development with Fairway Independent Mortgage Corp., Madison, Wis., with the 2021 Schumacher-Bolduc Award.

RE/MAX: Housing Inventory Remains Tightly Constricted

RE/MAX, Denver, said its latest National Housing Report found housing inventory levels remain extremely constricted across the U.S.

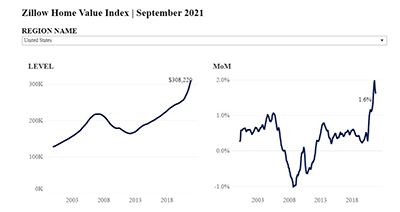

Zillow: Housing Market Moderation Gives Buyers Breathing Room

Zillow, Seattle, said the housing market’s modest calming, which began late in the summer, continued into early fall.

Consumer Survey Shows 2/3 of Americans Still Financially Unhealthy

The Financial Health Network, Chicago, said even as the financial health of many Americans improved over the past year, a full two-thirds of Americans remain vulnerable in their financial health.

Wuthering Heights: Rent Control Proposals Make the Rounds

Many would agree that commercial real estate has not had a classic economic downturn since the Great Recession. That is important to consider in business planning generally, and specifically as apartment rents increase across the country.

MBA Advocacy Update Oct. 25 2021

On Monday, in remarks given at MBA’s Annual Convention and Expo 2021, FHFA Acting Director Sandra Thompson announced two steps to advance housing sustainability and affordability.

Quote

“More than 25% of loans in forbearance are now made up of new forbearance requests and re-entries, while many other homeowners who have reached the end of 18-month terms are successfully exiting into deferrals or modifications.”

–MBA Chief Economist Mike Fratantoni.