Consumer Survey Shows 2/3 of Americans Still Financially Unhealthy

The Financial Health Network, Chicago, said even as the financial health of many Americans improved over the past year, a full two-thirds of Americans remain vulnerable in their financial health.

The company’s fourth annual Financial Health Pulse: 2021 U.S. Trends Report showed a “dueling narrative” of financial health in America as the pandemic recovery sits at an inflection point.

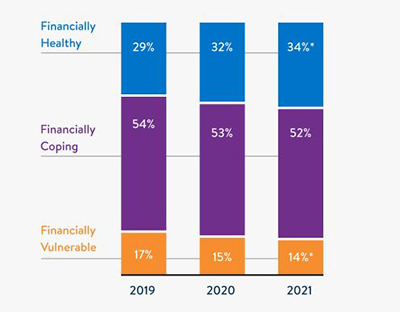

On the one hand, the study found, overall financial health improved over the last year, with more than a third (34%) of people in America now considered financially healthy, a two percentage-point increase from 2020 and the highest level since FHN began measuring in 2018. It said government relief programs and changes in consumer spending were particularly effective at both reaching vulnerable populations and at reducing their hardship,

Yet, two-thirds of Americans, or 187 million people, are still not financially healthy — whether considered Financially Coping (52%) or Financially Vulnerable (14%). And stark racial inequities remain: 39% of White individuals are considered Financially Healthy, while only 21% of Black and 24% of Latinx individuals are.

“The overall improvement in financial health shows that government interventions can have a powerful impact on the most vulnerable, including marginalized communities, but these gains are at risk as relief programs wind down,” said Jennifer Tescher, president and CEO of Financial Health Network.

Other report findings:

- Financially Vulnerable individuals were 3 times more likely to receive government relief than the Financially Healthy.

- People with insufficient emergency savings were 2 times more likely to receive relief as those with sufficient emergency savings

- Recipients of mortgage or rent relief were 50 percent less likely to experience increased housing insecurity in 2021 relative to 2020 (when compared with people who applied for this relief but did not receive it).

- Black people who received stimulus payments were 22 percent less likely to become Financially Vulnerable (compared with Black people who did not receive stimulus payments).

- Latinx people who received stimulus payments were 21 percent less likely to become Financially Vulnerable (compared with Latinx people who did not receive stimulus payments).

- Low-income people who received unemployment benefits were 62 percent less likely to become Financially Vulnerable (compared with those who applied and did not receive these benefits).

- Additionally, more than a third (34%) of individuals who received a stimulus payment reported using it to pay off their credit card debt.