Investors are following shoppers as they return to lifestyle centers, said JLL, Chicago.

Category: News and Trends

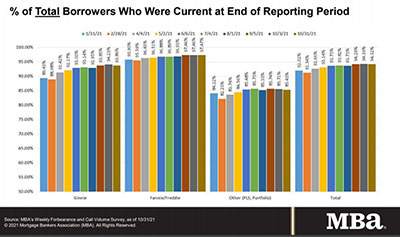

Final MBA Forbearance & Call Volume Survey: Mortgage Loans in Forbearance Drops to 2.06%

The Mortgage Bankers Association issued its final Forbearance and Call Volume Survey on Monday; 77 weeks after its first survey, MBA reported one million homeowners in forbearance plans, down from more than six million in mid-2020.

MORPAC Commemorates 50 Years

MORPAC marked 50 years of achievements on Monday, October 18, at the Advocacy Reception during the recent MBA Annual Convention & Expo in San Diego.

CREF22 in San Diego Feb. 13-16

The Mortgage Bankers Association’s Commercial Real Estate Finance/Multifamily Housing Convention & Expo takes place Feb. 13-16 at the Manchester Grand Hyatt in San Diego.

Nomi Smith of PMI Rate Pro: How to Build a Stronger Mortgage Business Now

It’s time to make a decision. What will you be doing in 2022? If you’re in the mortgage industry and you think you’ll still be in the business next year, there’s a good chance you’re wrong. The business will shrink next year and many who are working here now won’t be here by the end of the year.

MBA Advocacy Update Nov. 8, 2021

House leaders continued to lay the groundwork – both substantively and procedurally – to hold a floor vote on the latest iteration of President Biden’s Build Back Better Act tax and reconciliation package. MBA remains engaged and will provide any necessary updates.

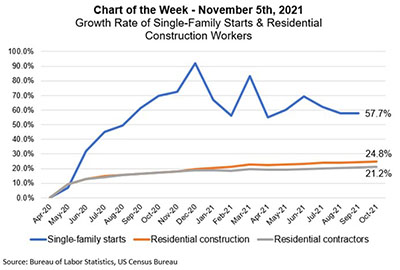

MBA Chart of the Week Nov. 5 2021: Single-Family Starts, Residential Construction Workers

This week’s MBA Chart of the Week examines the growth rates of single-family construction and residential construction workers since the trough in home building activity in April 2020.

Quote

“One million homeowners remained in forbearance as we reached the end of October, but the forbearance share continued to decline, with larger declines for portfolio and PLS loans.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Regina Braga of Res/Title: Margin Compression Doesn’t Have to Be Inevitable in a Competitive Market

Lenders should consider examining existing or new service providers for critical services (title, appraisal or other elements of the mortgage process that would be difficult to produce in-house, but without which, a purchase mortgage transaction simply cannot take place) much as they would their own, internal cost centers.

Making Affordability A Priority: A Discussion with MBA’s Katelynn Harris Walker

MBA Newslink interviewed Katelynn Harris Walker, Associate Director of Affordable Housing Initiatives for the Mortgage Bankers Association, where she is dedicated full time to advocacy and engagement on affordability.