A new Consumer Financial Protection Bureau analysis sharply criticized the three major nationwide consumer reporting companies, alleging changes in complaint responses provided by Equifax, Experian and TransUnion resulted in fewer meaningful responses and less consumer relief.

Category: News and Trends

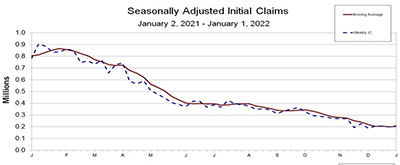

Initial Claims Slide Back Again

Initial claims for unemployment continued their yo-yo pattern, rising for the fourth time in seven weeks, the Labor Department reported Thursday.

CREF22 in San Diego Feb. 13-16

The Mortgage Bankers Association’s Commercial Real Estate Finance/Multifamily Housing Convention & Expo takes place Feb. 13-16 at the Manchester Grand Hyatt in San Diego.

Master-Planned Community Developers Optimistic Amid Supply Chain Concerns

Home sales in the nation’s 50 top-selling master planned communities grew by a modest 5 percent in 2021 from 2020, reported RCLCO, Bethesda, Md., with a 14% decrease in sales in the second half of the year as supply chain issues manifested.

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

Quote

“Demand for new single-family homes within [master-planned communities] remains high, with favorable demographic tailwinds suggesting this strong demand will continue in 2022. However, supply chain disruptions and the lingering impacts of COVID-19 have prevented many MPCs from fully capitalizing on the growth in demand seen over the past year.”

–RCLCO Managing Director Gregg Logan.

Bruce Schultz of Gateway First Bank: Promoting Affordable Homeownership in the Age of COVID

The COVID-19 pandemic presents residential mortgage lenders with an opportunity to expand their role in a critically needed area of community development – advancing affordable homeownership.

Call For Speakers: MBA Technology Solutions Conference & Expo; Deadline TODAY

The Mortgage Bankers Association issued a Call for Speakers for its Technology Solutions Conference & Expo 2022, taking place April 11–14 at the Bellagio Las Vegas. Deadline for proposals is Friday, Jan. 7.

People in the News Jan. 7, 2022: Lenderworks Names Alexandra Temple Chief Legal Officer

Lenderworks, Fairfax, Va., named Alexandra Temple to serve as its Chief Legal Officer, responsible for all legal affairs, including legal counsel, oversight of compliance and regulatory matters and risk management.

Fred Gooch of First American Docutech: National RON Standard Will Boost Lender, Borrower Adoption of Digital Closings

Importantly, the SECURE Notarization Act does not replace traditional in-person notarization, which will remain an option for anyone who chooses it. Rather, it simply allows RON as an additional alternative for lenders and consumers. The SECURE Notarization Act preserves and expands consumer choice.