While there are more tools, technology advancements, access to data and specific programs tailored to minority consumers and marginalized groups than ever before, there are still additional steps the industry can take to truly make homeownership a reality for all.

Category: News and Trends

Sam Verma of Peoples Processing: Automation–A Critical Element for the Emerging Non-QM Sector

Against the background of plummeting refinance activity, there has been a growing level of competition to service limited loan volume. Coupled with the tighter business conditions, market norms have rapidly changed, and so have the borrower profile. These changes have been encouraging lenders to consider getting into the Non-QM space to ensure smooth business continuity.

MBA Accounting & Financial Management Conference in Nashville Nov. 10-12

The Mortgage Bankers Association’s Accounting & Financial Management Conference takes place Nov. 10-12 at the Grand Hyatt Nashville.

Building Materials, Labor Shortages Hold Back Construction

Construction spending, while up year over year, continues to be hampered by building materials shortages and difficulties finding labor, the Census Bureau reported Monday.

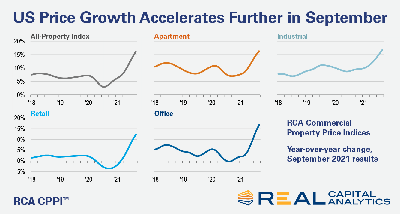

Commercial Property Price Growth Accelerates

Commercial real estate prices continue to increase, according to new reports from Real Capital Analytics and CoStar.

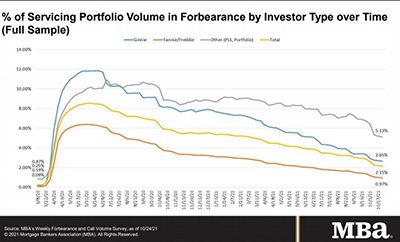

Share of Mortgage Loans in Forbearance Drops to 2.15%

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.

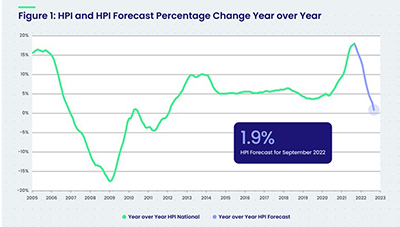

CoreLogic: Annual Home Price Growth Hits 18% in September as Supply/Demand Imbalances Intensify

Demand for homebuying remained strong in September, said CoreLogic, Irvine, Calif., with limited housing supply creating challenges for those looking for homes.

People in the News Nov. 2, 2021

Cherry Creek Mortgage, Denver, promoted Susan Vick to Vice President of Marketing.

Dealmaker: M&T Realty Capital Corp. Provides $15M for New York Multifamily Properties

M&T Realty Capital Corp., Baltimore, closed $14.6 million in agency and life company loans for three New York multifamily properties.

Jennifer Henry of Equifax: Accelerating Access to Credit for Marginalized Communities Can Provide Benefits on a National Scale

While there are more tools, technology advancements, access to data and specific programs tailored to minority consumers and marginalized groups than ever before, there are still additional steps the industry can take to truly make homeownership a reality for all.