The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

Category: News and Trends

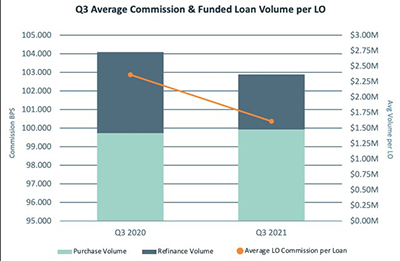

Waning Refi Volumes Spur Decline in LO Commissions

SimpleNexus, Lehi, Utah, said declining loan volumes in the third quarter pushed quarterly loan originator commission earnings by 17%.

MBA, Trade Groups Urge Senate Banking Committee to Approve LIBOR ‘Tough Legacy’ Legislation

The Mortgage Bankers Association and nearly two dozen industry trade groups urged members of the Senate Banking Committee to support federal legislation to address “tough legacy” contracts that currently reference LIBOR.

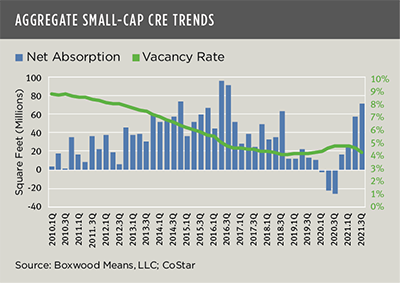

Small-Cap Commercial Real Estate Firing on All Cylinders

The economic rebound has boosted small businesses, giving small-cap commercial real estate leasing and investment markets a jolt, reported Boxwood Means LLC, Stamford, Conn.

Dealmaker: Bascom Group Closes $74M in Las Vegas Transactions

The Bascom Group LLC, Irvine, Calif., acquired a 216-unit multifamily community and a 93-unit single-family rental portfolio in Las Vegas for $74.3 million.

MBA Servicing Solutions Conference & Expo in Orlando Feb. 22-25

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Timothy Raty of Mortgage Cadence: USDA and the GSEs’ New Uniform Security Instruments

While Rural Development’s requirements lack details specific to the content of the security instruments used, they do have plenty of other requirements regarding the servicing of a loan which may not be completely compatible with the covenants within the SIs. The following summarizes the types of conflicts, additional requirements and near conflicts that may exist

Quote

“Mortgage rates decreased for the first time since August, as concerns about supply-chain bottlenecks, waning consumer confidence, weaker economic growth and rising inflation pushed Treasury yields lower.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

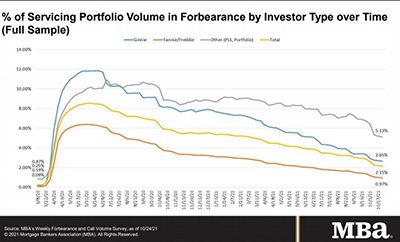

Share of Mortgage Loans in Forbearance Drops to 2.15%

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.

People in the News Nov. 3, 2021

Cherry Creek Mortgage, Denver, promoted Susan Vick to Vice President of Marketing.