House leaders continued to lay the groundwork – both substantively and procedurally – to hold a floor vote on the latest iteration of President Biden’s Build Back Better Act tax and reconciliation package. MBA remains engaged and will provide any necessary updates.

Category: News and Trends

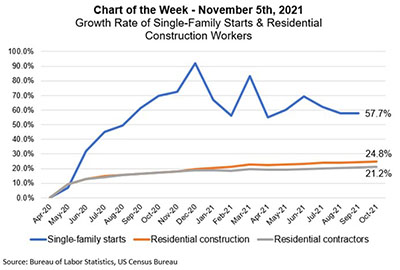

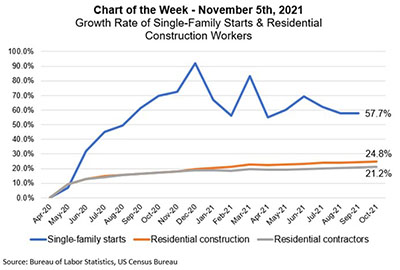

MBA Chart of the Week Nov. 5 2021: Single-Family Starts, Residential Construction Workers

This week’s MBA Chart of the Week examines the growth rates of single-family construction and residential construction workers since the trough in home building activity in April 2020.

Quote

“One million homeowners remained in forbearance as we reached the end of October, but the forbearance share continued to decline, with larger declines for portfolio and PLS loans.”

–Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Regina Braga of Res/Title: Margin Compression Doesn’t Have to Be Inevitable in a Competitive Market

Lenders should consider examining existing or new service providers for critical services (title, appraisal or other elements of the mortgage process that would be difficult to produce in-house, but without which, a purchase mortgage transaction simply cannot take place) much as they would their own, internal cost centers.

Making Affordability A Priority: A Discussion with MBA’s Katelynn Harris Walker

MBA Newslink interviewed Katelynn Harris Walker, Associate Director of Affordable Housing Initiatives for the Mortgage Bankers Association, where she is dedicated full time to advocacy and engagement on affordability.

Tom Lamalfa: October 2021 MBA Annual Convention & Expo Survey

In early October I surveyed 34 senior executives from 34 separate mortgage companies about an array of issues and topics both relevant and consequential to the mortgage banking industry. It was the 26th time since 2008 that this survey has been conducted and published by the MBA.

Timothy Raty of Mortgage Cadence: USDA and the GSEs’ New Uniform Security Instruments

While Rural Development’s requirements lack details specific to the content of the security instruments used, they do have plenty of other requirements regarding the servicing of a loan which may not be completely compatible with the covenants within the SIs. The following summarizes the types of conflicts, additional requirements and near conflicts that may exist

MBA Advocacy Update Nov. 8, 2021

House leaders continued to lay the groundwork – both substantively and procedurally – to hold a floor vote on the latest iteration of President Biden’s Build Back Better Act tax and reconciliation package. MBA remains engaged and will provide any necessary updates.

MBA Chart of the Week Nov. 5 2021: Single-Family Starts, Residential Construction Workers

This week’s MBA Chart of the Week examines the growth rates of single-family construction and residential construction workers since the trough in home building activity in April 2020.

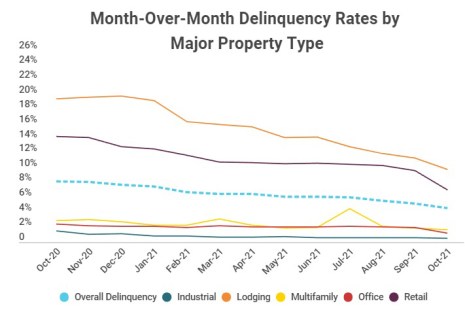

CMBS Delinquency Rate Tumbles

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined sharply again in October.