CMBS Delinquency Rate Tumbles

Chart courtesy of Trepp LLC

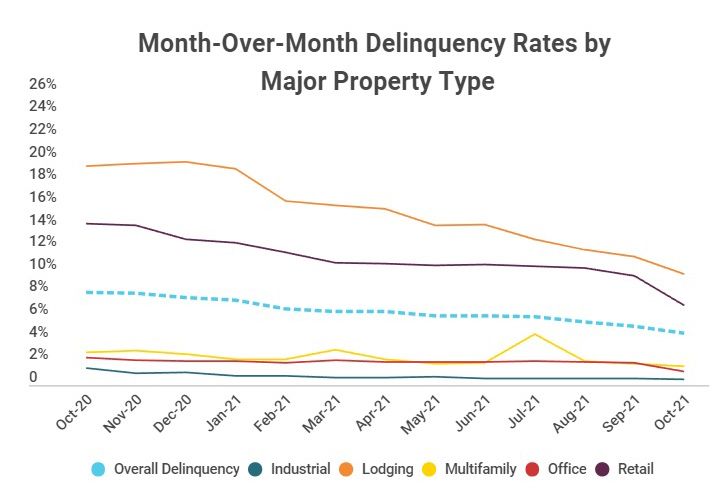

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined sharply again in October.

Trepp Senior Managing Director Manus Clancy said the headline delinquency figure fell below 5 percent, largely due to big drops in the lodging and retail segments. “The October decline was the largest since February,” he said. “After two huge increases in May and June 2020, the rate has now fallen for 16 consecutive months.”

The October CMBS delinquency rate equaled 4.61 percent, down 64 basis points from September, Trepp said. The percentage of loans in the 30-day delinquent bucket equaled 0.23 percent, down one basis point for the month.

Fitch Ratings, New York, said it expects the delinquency rate will continue to stabilize and dip below 3 percent by year end, outperforming the prediction the ratings agency made in early 2021, when it forecast the figure would end the year below 4 percent.

Fitch said the hotel sector had the highest delinquency rate at 11.05 percent, followed by retail at 8.22 percent (14.53 percent for regional malls) and office at 1.26 percent. Both the multifamily and industrial sectors had delinquency rates below 1 percent at 0.50 percent for apartments and 0.20 percent for industrial real estate.

New delinquencies totaled $614 million in September, consistent with $610 million in August, Fitch said. Resolutions totaled $1.5 billion, compared with $1.6 billion in August.

Kroll Bond Rating Agency, New York, reported CMBS private-label pricing volume ended October at $15.2 billion, bringing year-to-date issuance to $84.1 billion, an 83 percent increase year-over-year.

KBRA said up to 21 deals could launch in November, including up to 10 single-borrower transactions, five conduits, two Freddie Mac K-Series and as many as four commercial real estate collateralized loan obligation transactions.

Trepp reported the percentage of loans with a special servicer fell to 7.17 percent in October from 7.49 percent in September, led by lodging and retail loans. For lodging loans, 16.17 percent were with the special servicer, a 67-basis-point decline month-over-month. For retail loans, 13.68 percent were in special servicing, down 33 basis points from September.