Commercial and multifamily mortgage loan originations were 49% lower in the third quarter of 2023 compared to a year ago, and decreased 7% from the second quarter, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Tag: Jamie Woodwell

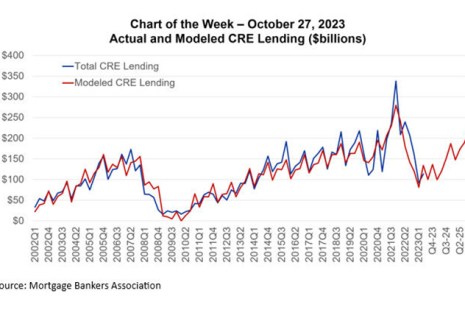

MBA Chart of the Week: Actual and Modeled CRE Lending ($Billions)

MBA’s latest commercial real estate finance (CREF) forecast anticipates 2023 origination volumes ($442 billion) will come in just a bit more than half of what they were in 2022 ($816 billion).

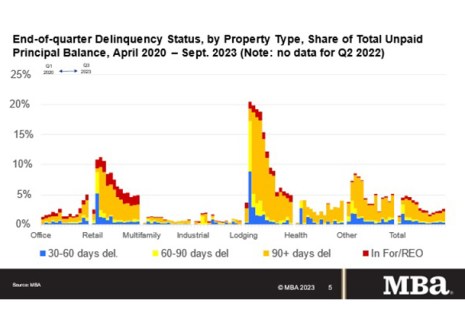

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increased Slightly in Third Quarter

Delinquency rates for mortgages backed by commercial and multifamily properties increased during the third quarter of 2023, according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.

MBA Forecast: Commercial/Multifamily Lending Expected to Fall 46% to $442 Billion in 2023

Total commercial and multifamily mortgage borrowing and lending is expected to fall to $442 billion this year, a 46% decline from 2022’s total of $816 billion. This is according to an updated baseline forecast released today by the Mortgage Bankers Association.

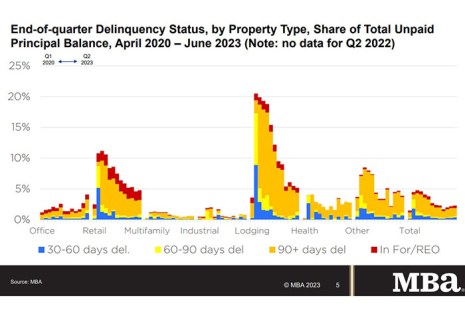

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increased in Second Quarter

Commercial and multifamily mortgage delinquencies increased in the second quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

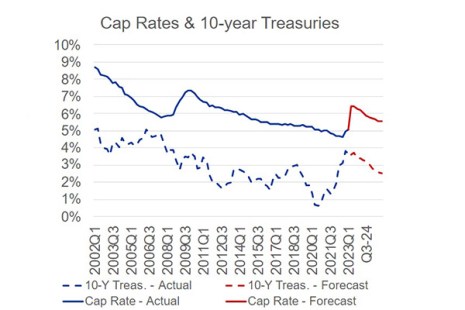

MBA Forecast: Higher Rates, Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending is expected to fall to $504 billion this year, a 38 percent decline from 2022’s $816 billion total. This is according to an updated baseline forecast released by the Mortgage Bankers Association.

MBA: Multifamily Lending Declined 1% in 2022 to $480 Billion

In 2022, 2,242 different multifamily lenders provided a total of $480.1 billion in new mortgages for apartment buildings with five or more units, the Mortgage Bankers Association’s annual report of the multifamily lending market said.

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increase Slightly

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly during the second quarter, the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey reported.

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increase in First Quarter

Commercial and multifamily mortgage delinquencies increased in the first quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

MBA Forecast: 2023 Commercial/Multifamily Lending to Fall 20%

CHICAGO–Total commercial and multifamily mortgage borrowing and lending is expected to fall to $654 billion this year, a 20 percent decline from $816 billion in 2022, according to an updated baseline forecast released here by the Mortgage Bankers Association at its 2023 Commercial/Multifamily Finance Servicing & Technology Conference.