MBA: 2023 Commercial, Multifamily Borrowing/Lending Expected to Fall to $700B

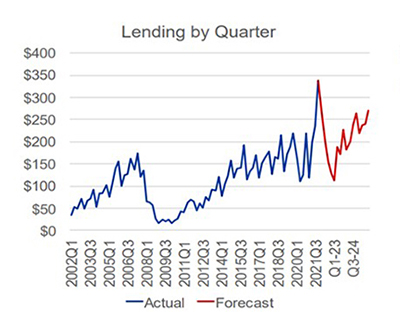

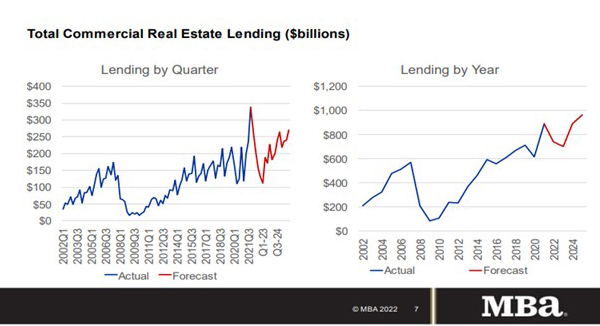

The Mortgage Bankers Association released its updated baseline forecast Thursday, projecting total commercial and multifamily mortgage borrowing and lending to fall to $700 billion this year, a 5 percent decline from an expected 2022 total of $740 billion.

Multifamily lending alone (which is included in the total figures) is expected to drop to $393 billion in 2023–an 11 percent decline from last year’s expected total of $439 billion. MBA anticipates borrowing and lending will rebound in 2024 to $887 billion in total commercial real estate lending and $483 billion in multifamily lending.

MBA Head of Commercial Real Estate Research Jamie Woodwell noted the typical FOMC member’s expectations for the federal funds rate at the end of 2023 increased throughout 2022, jumping from 1.6 percent to 5.1 percent as of December 2022.

“Those shifts in the outlook from the Federal Reserve are both a response to changing economic conditions and a cause of change themselves,” he said. “Commercial real estate markets are not immune to these shifts, and we expect borrowing and lending backed by commercial and multifamily properties to decline again this year. Uncertainty and volatility around the paths of the economy, interest rates, and property valuations will likely continue to cause instability for commercial real estate markets well into this year.”

For additional commentary on the pandemic’s impact on the sector, visit MBA’s Commercial/Multifamily Market Intelligence Blog here.

MBA’s commercial/multifamily members can download a copy of MBA’s latest Commercial/Multifamily Real Estate Finance Forecast at www.mba.org/crefresearch.