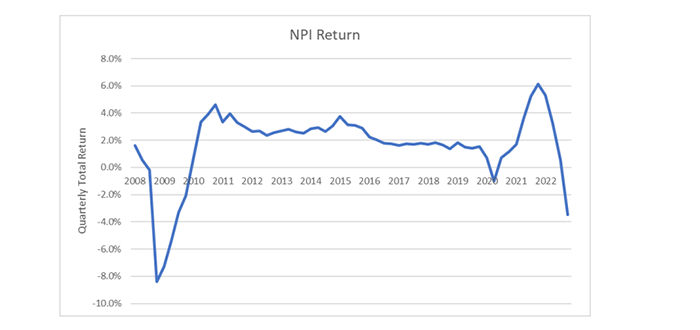

Largest Negative Returns for Institutional Real Estate Since Great Recession

The National Council of Real Estate Investment Fiduciaries reported institutional-quality commercial real estate returned -3.50% for the fourth quarter, the first negative return since the 2020 COVID pandemic and the largest since the Great Recession.

The quarterly return consisted of 0.95% from income and -4.45% from appreciation.

MBA Head of Commercial Real Estate Research Jamie Woodwell noted the fourth-quarter data show the first signs of meaningful declines in commercial real estate values, spawned by the rise in interest rates and investment yields that started last year. “A slowdown in transaction activity is clouding the picture of where markets really are valuing properties, meaning we may have to wait for data covering coming quarters to see where prices settle out,” he said.

NCREIF said market values before considering capital expenditures decreased by 4.08%, reflecting a significant increase in the number of writedowns during the quarter. Writedowns doubled from about 35% to 70% of the properties written down, the report said.

The -3.50% return represents the unleveraged return for operating properties held by institutional investors, NCREIF reported. As of Dec. 31, 2022, there were 4,672 properties with leverage and the weighted-average loan-to-value ratio equaled 42%. “Lower unleveraged returns coupled with higher interest rates magnified the negative return for those properties with leverage,” the report said.

Properties with leverage had a -6.44% total quarterly return on equity, NCREIF said. The average interest rate on the leveraged properties rose from 3.9% the third quarter to 4.3% for the fourth quarter. “A handful of properties had values which were equal to or less than their loan balance and a few properties were returned to the lender,” the report said.

NCREIF noted hotels “bucked the trend” in the fourth quarter as the only property type with a positive return. They returned 3.37% during the fourth quarter compared to 2.69% in the third. Offices saw the lowest return at -4.8%.

Market value weighted capitalization rates increased to 4.03% late 2022 compared to 3.82% in the third quarter. Net operating income growth was positive at 2.1% during the fourth quarter. “The higher capitalization rate suggests that the growth rate in NOI may be less over the next couple of years,” NCREIF said.