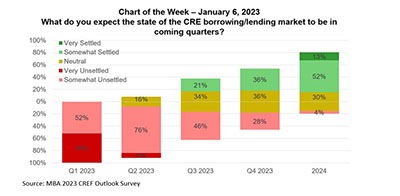

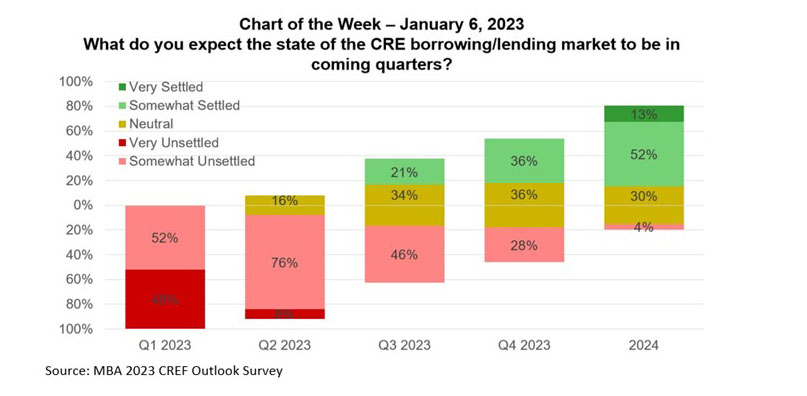

MBA Chart of the Week Jan. 12, 2023: CRE Lending/Borrowing

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

These are some of the key findings of MBA’s 2023 Commercial Real Estate Finance (CREF) Outlook Survey that collected insights from leaders of the top commercial/multifamily origination firms.

Every survey respondent considers today’s market either somewhat or very unsettled, but the majority expect the market to stabilize over the course of 2023. Other high-level findings include:

- Among property types, the office market is viewed as most negatively affecting today’s borrowing and lending markets while a majority of respondents view the industrial market outlook as having positive impacts.

- Cap rates and valuations, base interest rates, and mortgage spreads are all viewed as having negative impacts on today’s financing activity.

- In 2023, lenders are expected to have a (slightly) stronger appetite to lend than borrowers will have to borrow.

- Borrowing and lending volumes are expected to decline in 2023.

- No capital sources are broadly expected to see increases.

- There are more deals looking for debt than there is debt looking for deals.

- Across a variety of factors affecting the markets, more are seen as negative than positive for 2023.

MBA members can download a copy of the report at https://www.mba.org/news-and-research/forecasts-and-commentary/cref-outlook-survey.

We’ll be discussing these trends and more at MBA’s Commercial/Multifamily Finance Convention and Expo, February 12 – 15 in San Diego. We hope to see you there!

–Jamie Woodwell jwoodwell@mba.org