CREF Policy Update: July 14, 2022

MBA and ACLI submitted a proposal last week to the NAIC to harmonize the life risk-based capital treatment of non-performing mortgages with the 2021 changes to the treatment of real estate investments. Also last week, MBA issued a white paper examining how climate change is dramatically reshaping lenders’ and policymakers’ approaches to the U.S. residential and commercial real estate markets.

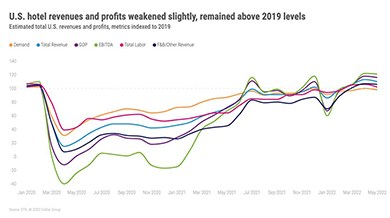

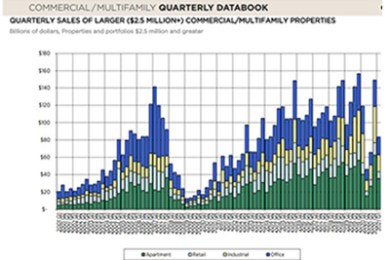

MBA Releases Q1 2022 Commercial/Multifamily DataBook

The Mortgage Bankers Association released its first quarter Commercial/Multifamily DataBook.

Dealmaker: Gantry Secures $35M to Refinance Seattle-Area Office Building

Gantry, San Francisco, secured $35.4 million to refinance a five-story, 200,000-square-foot single-tenant office building at 1601 Lind Ave SW in Seattle suburb Renton, Wash.

Jeff Coles of Berkadia on Single-Family Rental/Build-for-Rent Markets

Jeff Coles is Vice President of Institutional Client Services with Berkadia, Washington, D.C. He partners with Dori Nolan, Senior Vice President of Client Services, to grow Berkadia's relationships with current and new institutional investor clients.

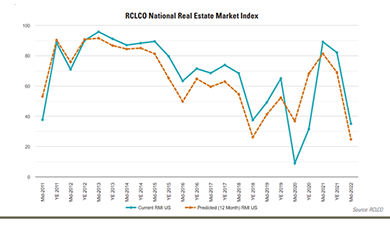

Commercial Real Estate Sentiment Dips Toward Recession Zone

Commercial real estate executives’ market sentiment has dropped dramatically, reported RCLCO, Washington, D.C.

MBA Commercial/Multifamily Members Discuss What Membership Means to Them

The Mortgage Bankers Association is the voice of the entire real estate finance industry. In this video, MBA commercial and multifamily members discuss what the organization means to them and the benefits they receive from MBA's conferences, education and advocacy.

JLL: Real Estate Transparency Gap Widens in Favor of Leading Global Markets

JLL, Chicago, said while many of the world's leading commercial real estate markets in North America, Western Europe and Australasia are becoming more transparent, most other countries struggle to maintain the pace of transparency improvement.