Hotel Profitability Drops

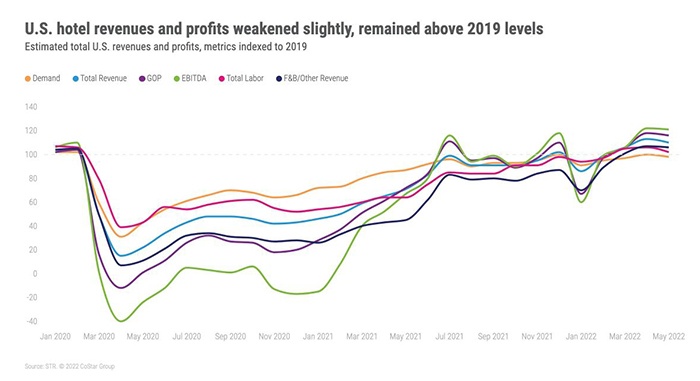

U.S. hotel gross operating profit per available room fell in May. But GOPPAR surpassed its pre-pandemic comparable for a third consecutive month, reported STR, Hendersonville, Tenn.

“After the top-line metrics showed mixed results in May, it wasn’t a surprise that the bottom-line metrics came in a bit lower,” said Raquel Ortiz, STR Director of Financial Performance. But she noted each of the four key hotel profit and loss metrics: total revenue per available room, gross operating profit per available room, profitability (EBITDA) and labor costs per available room, improved compared to 2019.

“We continue to keep a close eye on food and beverage income as group demand levels rise,” Ortiz said. “F&B revenues are gradually moving closer to 2019 levels, but catering and banquet revenues continue to lag.”

STR reported eight of the largest U.S. hotel markets realized both gross operating profit per available room and total revenue per available room levels were higher than 2019 comparables.

“With increased business demand, the top 25 hotel markets are showing improved profit levels,” Ortiz said. “Miami, primarily because of higher room rates, continues to lead in both gross operating profit per available room and total revenue per available room recovery… Markets with the lowest gross operating profit in May included San Francisco and Oahu Island, Hawaii.”

STR said U.S. hotel performance dipped last week from the week before. “Given historical trends, the week-over-week decline in demand was normal given the [July 4] holiday,” it said. “Since 2000, the Fourth of July or the observance of the holiday has fallen on a Monday seven times, including last year and in 2016. In every case, occupancy in the week before the holiday fell by more than four percentage points with most of the losses beginning on Wednesday and continuing into the weekend.”

STR said U.S. hotel occupancy and demand will likely fall again this week before strengthening in late July.