MBA, California MBA Oppose California Props. 15 and 21

On Election Day, Californians will vote for or against two ballot initiatives strongly opposed by the Mortgage Bankers Association, California MBA and other industry partners.

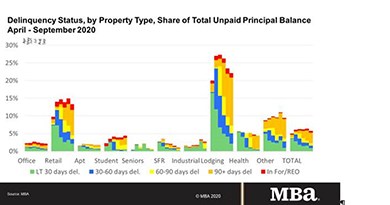

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

CREF Highlights Oct. 1, 2020

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

MBA: 2Q Commercial/Multifamily Mortgage Debt Rises

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

MBANow: MBA Chairman Brian Stoffers, CMB

With Californians set to vote on ballot initiative Propositions 15 and 21 on Election Day, MBA 2020 Chair Brian Stoffers, CMB, joined MBANow to discuss the initiatives, MBA and its coalition partners’ opposition to them and how MBA members can help.

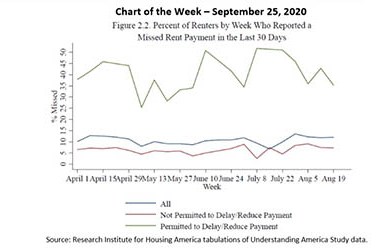

MBA Chart of the Week: Rent Payments and COVID-19

On September 17, the Research Institute for Housing America, MBA’s think tank, released a special report on housing-related financial distress during the second quarter – the first three months of the pandemic in the U.S.

Personnel News from Marcus & Millichap, NorthMarq, Eastern Union

Marcus & Millichap named Mark Ruble Executive Managing Director, the highest designation a Marcus & Millichap investment professional can attain.

Dealmaker: Berkadia Arranges $66M for Florida Multifamily

Berkadia secured $66.2 million in financing for two Florida multifamily properties.

Fitch: Secular Shifts Force U.S. Commercial Real Estate to Adapt

Fitch Ratings, New York/London, said post-pandemic, many U.S. commercial real estate segments will be transformed by the way space is used, which will have long-term consequences for property performance and financeability.