MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

MBA developed the survey to better understand how the pandemic is affecting commercial mortgage loan performance.

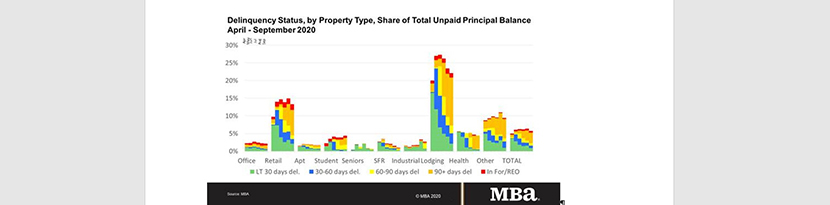

“Commercial and multifamily mortgage performance has stabilized, and in many cases, has begun to slowly improve since the initial stress of April and May,” said MBA Vice President of Commercial Real Estate Research Jamie Woodwell. “Lodging and retail properties felt the onset of the recession most immediately and dramatically, and that continues to show in the numbers. Delinquency rates remain more muted among other property types and overall, the inflow of newly delinquent loans has slowed to one-fourth the rate seen in April.”

Key Findings from MBA’s CREF Loan Performance Survey for September 2020:

The share of commercial and multifamily loan balances that were current increased in September, rising to 94.3% from 93.6% in August, with fewer new loans becoming delinquent.

• The share of loans that are 90-plus days delinquent rose slightly from 2.9% to 3.0%.

• The share of loans that are 60-90 days delinquent held steady at 0.6%.

• The share of loans that are 30-60 days delinquent fell from 0.8% to 0.7%.

• The share of loans less than 30 days delinquent fell from 1.6% to 0.9%.

Despite minor improvements, delinquency rates remain elevated in the lodging and retail sectors.

• 22.1% of the balance of lodging loans was delinquent, down from 23.5% in August.

• 13.3% of the balance of retail loans was delinquent, down from 15.0% in August.

Among other property types, delinquencies declined in September and remain relatively muted.

• 4.4% of health care loan balances were delinquent, down from 4.7% in August.

• 2.7% of industrial loan balances were delinquent, down from 3.4% in August.

• 2.1% of office loan balances were delinquent, down from 2.4% in August.

• 1.7% of multifamily loan balances were delinquent, down from 1.9% in August.

Because of the higher concentration of hotel and retail properties, delinquencies of commercial mortgage-backed securities loans have been more impacted than other capital sources.

• 10.9% of the balance of CMBS loans was delinquent in September, down from 12.5% in August.

Among other capital sources, delinquency rates held steady in September.

• 2.6% of FHA loan balances were delinquent, up from 2.4% in August.

• 1.9% of life company loan balances were delinquent, down from 2.4% in August.

• 1.3% of GSE loan balances were delinquent, unchanged from August.

The volume of borrower inquiries and requests continued to fall in September.

• Borrower inquiries represented 0.4% of the outstanding balance of loans, down from 0.7% in August.

• Requests represented 0.2% (down from 0.4% in August), and executed actions represented 1.0% (down from 1.4% in August).

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of September 20, 2020, and on borrower inquiries, requests and actions taken between August 20 and September 20, 2020. This month’s results build on similar monthly surveys conducted since April. Participants reported on $1.9 trillion of loans in August, representing approximately 50% of the total $3.7 trillion in commercial and multifamily mortgage debt outstanding. The average loan unpaid principal balance was $16 million.

Visit https://www.mba.org/store/products/research/general/report/commercial-real-estate-finance-loan-performance-survey for more information on MBA’s CREF Loan Performance Survey for September 2020.