While most will be monitoring increased infections and the progress of vaccine distribution and effectiveness, loan servicing and asset management professionals will have some additional factors impacting their organizations and books of business in the new year.

Tag: Mortgage Servicing

MBA: 3Q Mortgage Production Volume Spurs Strong IMB Profits

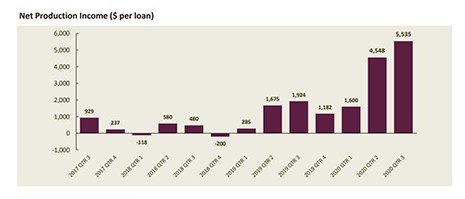

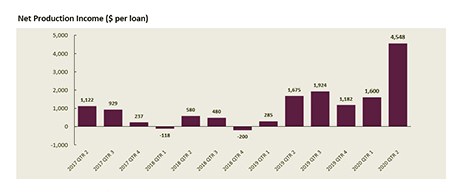

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported Thursday in its Quarterly Mortgage Bankers Performance Report.

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers and investors?

‘Ghosting’ and ‘Not OK? That’s OK:’ Servicing During a Pandemic

The COVID-19 pandemic has hit borrowers hard. But mortgage servicers are eager to help.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

What to Expect When Expecting Distress: A Servicer Roundtable

As COVID-19 and government responses continue to drive uncertainty around outcomes and outlooks, MBA Newslink interviewed senior professionals from a credit rating agency and several highly rated servicers to get their perspective on forbearance, loan workouts and portfolio management challenges for agency and non-agency CMBS.

CFPB: TRID Rule Results ‘Mixed, But Leans Positive’

The Consumer Financial Protection Bureau released its assessment of the TRID Integrated Disclosure Rule, acknowledging the rule resulted in “sizeable implementation costs” for mortgage lenders and servicers but finding the rule ultimately benefited consumers.

Jessica Longman: Education is Key–Reduce Homeowner Frustration Regarding Property Taxes

Some of the most common questions that servicers receive from customers revolve around property taxes. An important aspect to providing an excellent experience for your customers includes educating them on the critical pieces they need to know about their loan; in turn this will reduce call volume relating to property tax questions and reduce overall homeowner frustration about taxes and payments.

State Financial Regulators Seek Comment on ‘Prudential Standards’ for Nonbank Mortgage Servicers

The Conference of State Bank Supervisors seeks public input on proposed regulatory prudential standards for nonbank mortgage servicers, as the state-regulated industry covers an increasing share of this market.

MBA: Strong Borrower Demand, Low Rates Fuel 2Q IMB Production Profits

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $4,548 on each loan they originated in the second quarter, up from $1,600 per loan in the first quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.