Scaling QC without sacrificing consistency best positions servicers to manage risk, protect the customer experience and remain resilient through 2026.

Tag: Mortgage Servicing

Vertyx’s Ayo Opeyemi: Borrower Recapture Isn’t a Marketing Problem. It’s a Data Problem.

Vertyx Co-Founder Ayo Opeyemi says AI-powered insights allow servicing teams to engage as trusted advisors, proactively presenting options when they’re most relevant to the borrower’s financial goals.

Mortgage Servicing: Getting Reg X Reform Right is a Top Priority for 2025

Preventing foreclosures requires active collaboration between servicers and homeowners.

S&P: U.S. Insurers, Homeowners Face Greater Risks and Costs Due to Extreme Weather

U.S. insurers and homeowners face greater risks and higher costs as extreme weather events including hurricanes, wildfires and floods become more frequent and intense, according to S&P Global Ratings, New York.

Clarifire’s Jane Mason: To Survive, the Fittest Organizations Need AI—But That’s Not All

AI holds the potential to unleash productivity throughout the mortgage lifecycle by bringing the origination and servicing sides of the business together.

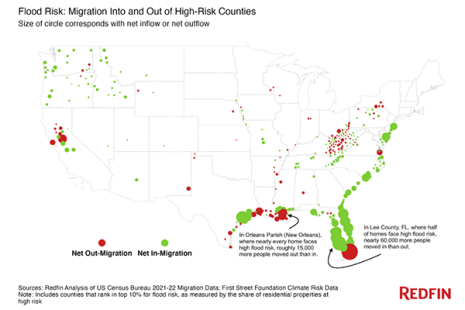

Redfin Reports Migration Into Flood-Prone Areas Has More Than Doubled Since 2020

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, reported Redfin, Seattle.

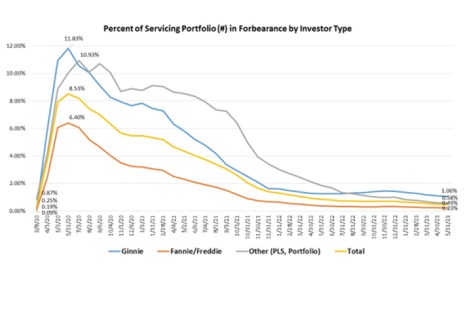

MBA: Share of Mortgage Loans in Forbearance Drops to 0.49% in May

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

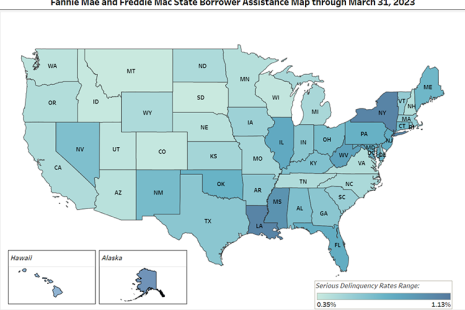

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.

U.S. Foreclosure Activity Spikes in May

Foreclosure filings–default notices, scheduled auctions or bank repossessions–increased 7% in May from April and 14% from a year ago, reported ATTOM, Irvine, Calif.

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.