TransUnion, Chicago, released a new analysis finding a correlation between rising payment-to-income ratios and rising mortgage delinquencies.

Tag: Mortgage Delinquencies

VantageScore: May Mortgage Delinquencies Increase the Most Among Credit Products

Mortgage loans led an increase in early- and mid-stage delinquencies across all credit categories in May, according to new CreditGauge report from VantageScore, San Francisco, Calif.

Mortgage Delinquencies Increase Slightly in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.04% of all loans outstanding at the end of the first quarter of 2025, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

MBA: Mortgage Delinquencies Increase in Second Quarter

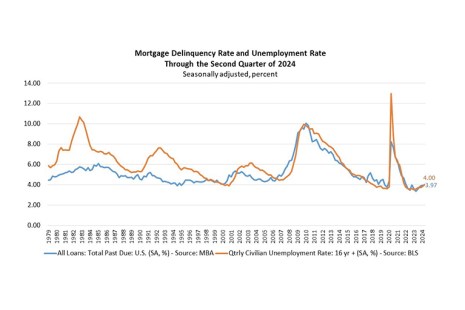

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

MBA: Mortgage Delinquencies Increase Slightly in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94% of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

ICE First Look: Delinquencies Down in January

Intercontinental Exchange Inc., Atlanta, released its “first look” at mortgage performance, reporting the national delinquency rate dropped to 3.38% in January. That’s the lowest level since October.

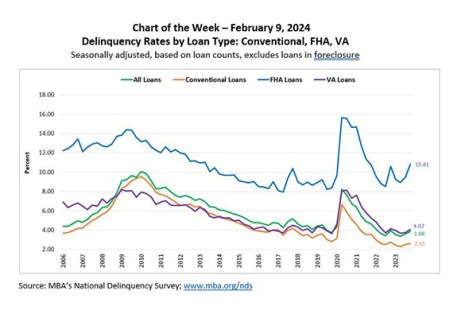

MBA Chart of the Week: Delinquency Rates by Loan Type

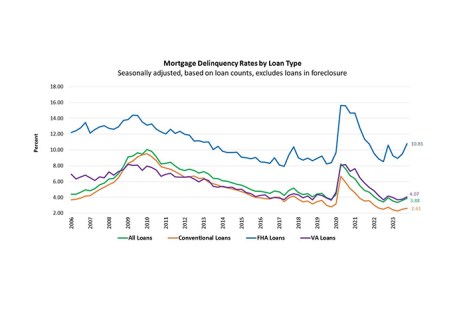

According to the latest MBA National Delinquency Survey (NDS), the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023.

MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.88% of all loans outstanding at the end of the fourth quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

MBA: Mortgage Delinquencies Increase in the Third Quarter

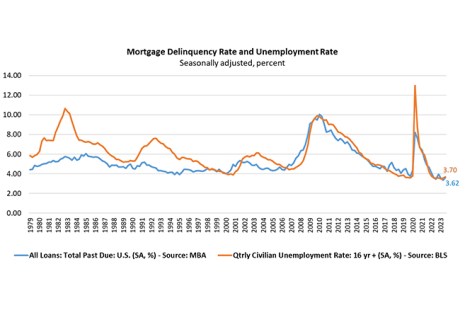

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62% of all loans outstanding at the end of the third quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

TransUnion: Mortgage Originations Down Almost 37% in Third Quarter Amid Higher Credit Balances

TransUnion, Chicago, Ill., released its Q3 2023 Quarterly Credit Industry Insights Report, finding higher interest rates and prices for goods have pushed credit balances up. Simultaneously, mortgage originations–and other new credit accounts such as automobile loans–are lagging last year.