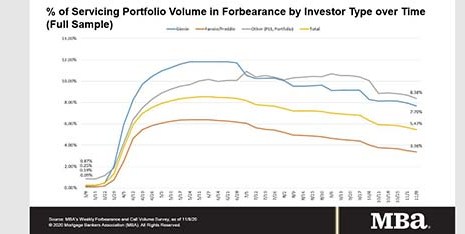

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased for the 11th week in a row, to 5.47% of servicers’ portfolio volume as of Nov. 8 from 5.67% the prior week – a 20-basis-point improvement. MBA now estimates 2.7 million homeowners are in forbearance plans.

Tag: Mike Fratantoni

MBA: Share of Mortgage Loans in Forbearance Decreases to 5.67%

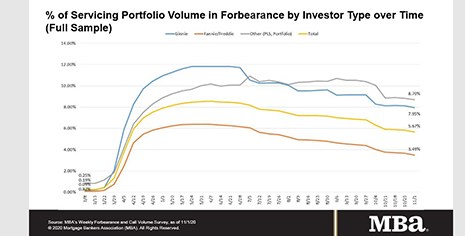

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 16 basis points to 5.67% of servicers’ portfolio volume as of Nov. 1, from 5.83% the prior week. MBA now estimates 2.8 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 5.83%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey revealed the total number of loans now in forbearance decreased by 7 basis points from 5.90% of servicers’ portfolio volume in the prior week to 5.83% as of October 25, 2020.

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

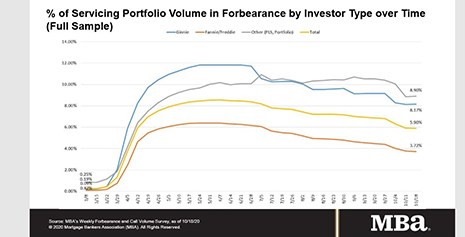

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

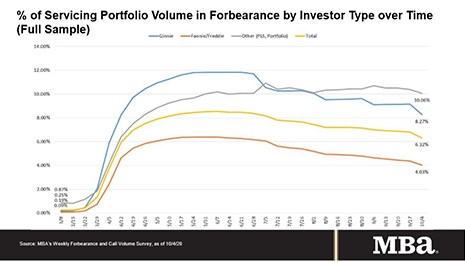

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Drops to 6.32%

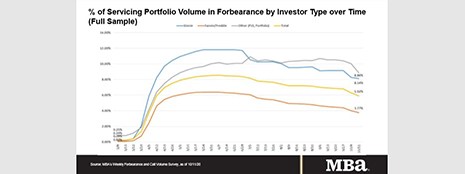

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 49 basis points to 6.32% of servicers’ portfolio volume in the prior week as of October 4 from 6.81% the previous week. MBA estimates 3.2 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Falls to 6.81%

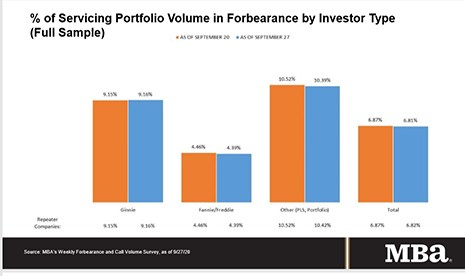

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.81% of servicers’ portfolio volume as of Sept. 27, from 6.87% the prior week. MBA now estimates 3.4 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 6.87%

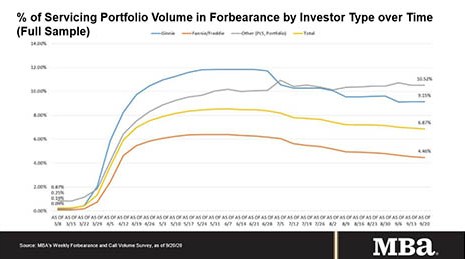

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 6.87% of servicers’ portfolio volume as of September 20, from 6.93% the prior week. MBA estimates 3.4 million homeowners remain in forbearance plans.

MBA: Loans in Forbearance Fall to Lowest Level in 5 Months

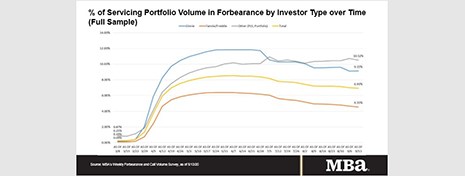

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.