The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 7 basis points from 0.47% of servicers’ portfolio volume in the prior month to 0.40% as of January 31, 2025. According to MBA’s estimate, 200,000 homeowners are in forbearance plans.

Tag: Marina Walsh

MBA: Mortgage Delinquencies Increase in Fourth-Quarter 2024

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.98% of all loans outstanding at the end of the fourth quarter of 2024, according to the Mortgage Bankers Association’s National Delinquency Survey.

Share of Mortgage Loans in Forbearance Decreases Slightly to 0.47% in December

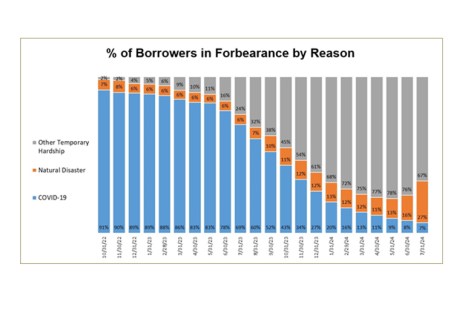

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 3 basis points from 0.50% of servicers’ portfolio volume in the prior month to 0.47% as of Dec. 31, 2024. According to MBA’s estimate, 235,000 homeowners are in forbearance plans.

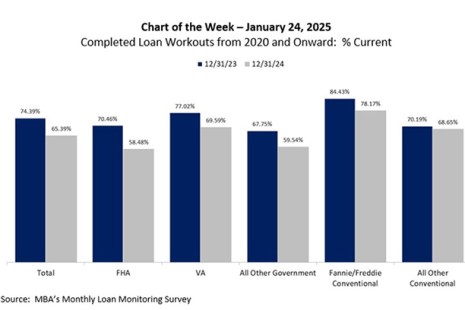

Chart of the Week: Completed Loan Workouts from 2020 Onward

According to the latest results from MBA’s Monthly Loan Monitoring Survey, approximately 235,000 homeowners are in forbearance plans as of December 31, 2024. This level is substantially lower than the peak of almost 4.3 million homeowners in June 2020 and the 8.5 million borrowers who have been provided forbearance since March 2020.

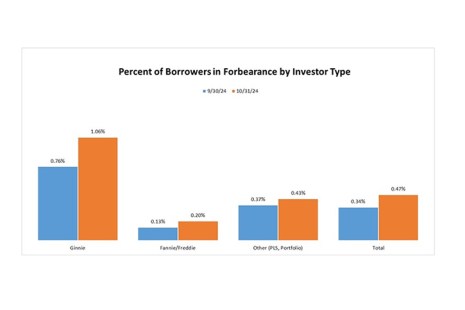

Share of Mortgage Loans in Forbearance Increases to 0.47% in October, MBA Reports

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.47% as of Oct. 31, 2024.

MBA’s Chart of the Week: Pre-Tax Net Production Income and Production Volume

Independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net profit of 17 basis points, or $693 on each loan they originated in the second quarter of 2024, an increase from the reported loss of 25 basis points, or $645 per loan in the first quarter of 2024, according to the Mortgage Bankers Association’s (MBA) newly released Quarterly Mortgage Bankers Performance Report.

MBA Reports Share of Mortgage Loans in Forbearance Increases to 0.27% in July

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.27% as of July 31, 2024. According to MBA’s estimate, 135,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.

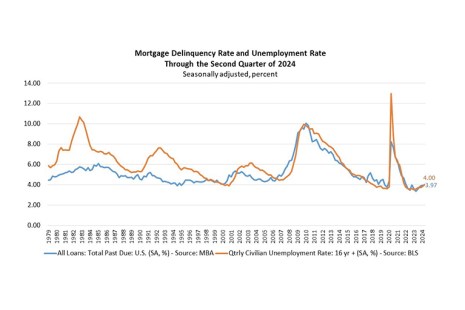

MBA: Mortgage Delinquencies Increase in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

MBA Chart of the Week: Early-Stage vs. Seriously Delinquent Mortgage Rates

According to the latest results from MBA’s National Delinquency Survey (NDS) released last week, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter of 2024. The delinquency rate was up 60 basis points from one year ago.

MBA: Share of Mortgage Loans in Forbearance Increases to 0.23% in June

The Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.23% as of June 30, 2024.