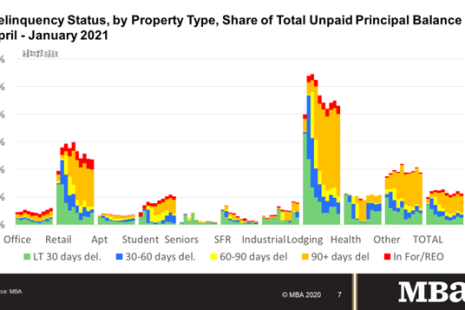

Delinquency rates for mortgages backed by commercial and multifamily properties decreased in January, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

Tag: Jamie Woodwell

MBA: December Commercial/Multifamily Mortgage Delinquencies Rise

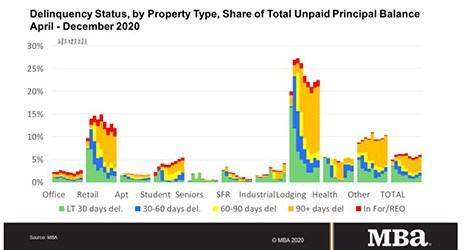

Delinquency rates for mortgages backed by commercial and multifamily properties Increased for the second month in a row in December, according to the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey.

MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.

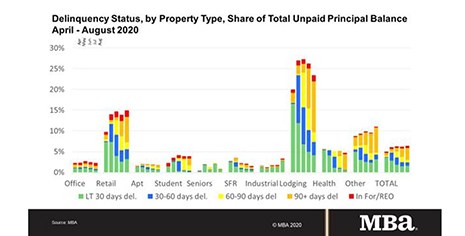

MBA: Commercial/Multifamily Mortgage Delinquency Rates Continue to Vary by Property Types, Capital Sources

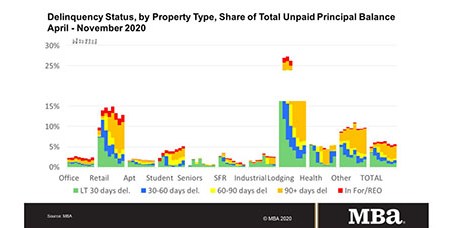

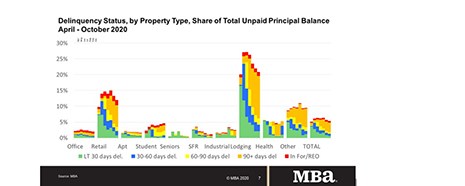

Commercial and multifamily mortgage performance remains mixed, revealing the various impacts the COVID-19 pandemic has had on different types of commercial real estate, according to two reports released Thursday by the Mortgage Bankers Association.

Commercial, Multifamily Borrowing Falls 47% in Third Quarter

Commercial and multifamily mortgage loan originations were 47 percent lower in the third quarter compared to a year ago, and increased 12 percent from the second quarter of 2020, the Mortgage Bankers Association reported.

Commercial, Multifamily Delinquencies Decline in October

Delinquency rates for mortgages backed by commercial and multifamily properties declined in October, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

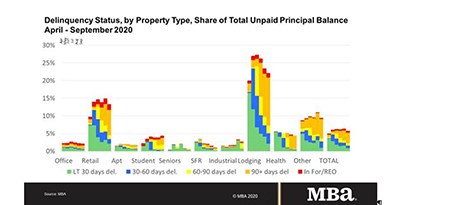

MBA: September Commercial, Multifamily Mortgage Delinquencies Decrease

Delinquency rates for mortgages backed by commercial and multifamily properties declined in September, the Mortgage Bankers Association’s latest monthly MBA CREF Loan Performance Survey reported.

MBA: 2Q Commercial/Multifamily Mortgage Debt Rises

The Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding report found commercial and multifamily mortgage debt outstanding rose by $43.6 billion (1.2 percent) in the second quarter.

MBA: Pandemic Takes Aim at Commercial, Multifamily Mortgage Delinquency Rates

The coronavirus pandemic had a “dramatic and immediate impact” on delinquency rates for some mortgages backed by commercial and multifamily properties in the second quarter, although most continued to perform well, the Mortgage Bankers Association said today in two reports.

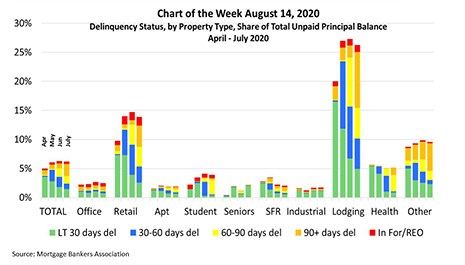

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.