MBA: 3Q Commercial/Multifamily Mortgage Debt Up 1.5%

Commercial/multifamily mortgage debt outstanding rose by $57.0 billion (1.5 percent) in the third quarter, the Mortgage Bankers Association reported this morning.

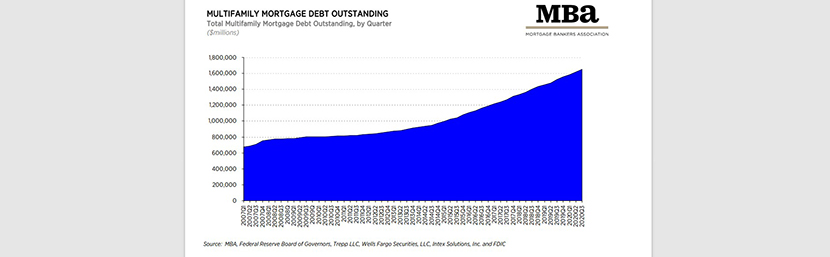

Total commercial and multifamily debt outstanding rose to $3.82 trillion at the end of the third quarter, the MBA Commercial/Multifamily Mortgage Debt Outstanding quarterly report found. Multifamily mortgage debt alone increased $31.0 billion (1.9 percent) to $1.6 trillion from the second quarter.

“The amount of mortgage debt backed by commercial and multifamily properties increased for the thirty-third straight quarter,” said MBA Vice President for Commercial Real Estate Research Jamie Woodwell. “Despite a significant fall-off in acquisition financing in the last two quarters, loan refinancings, particularly for FHA, Fannie Mae, Freddie Mac and bank balance sheets, helped lift total mortgage balances.”

Woodwell said continued uncertainty about the pandemic’s long-term impacts is likely to weigh on new financing in the coming quarters, “but the recent news of effective vaccines provides a helpful gauge of how far away the light is at the end of the tunnel,” he said.

The four largest investor groups are: banks and thrifts; federal agency and government-sponsored enterprise portfolios and mortgage-backed securities; life insurance companies; and commercial mortgage-backed securities, collateralized debt obligations and other asset-backed securities issues.

Commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at $1.5 trillion. Agency and GSE portfolios and MBS are the second-largest holders of commercial/multifamily mortgages (21 percent) at $798 billion. Life insurance companies hold $577 billion (15 percent), and CMBS, CDO and other ABS issues hold $529 billion (14 percent). Many life insurance companies, banks and the GSEs purchase and hold CMBS, CDO and other ABS issues. These loans appear in the report in the “CMBS, CDO and other ABS” category.

MBA’s analysis summarizes the holdings of loans or, if the loans are securitized, the form of the security. For example, many life insurance companies invest both in whole loans for which they hold the mortgage note (and which appear in this data under Life Insurance Companies) and in CMBS, CDOs and other ABS for which the security issuers and trustees hold the note (and which appear here under CMBS, CDO and other ABS issues).

MULTIFAMILY MORTGAGE DEBT OUTSTANDING

Looking solely at multifamily mortgages in the third quarter, agency and GSE portfolios and MBS hold the largest share of total multifamily debt outstanding at $798 billion (48 percent), followed by banks and thrifts with $478 billion (29 percent), life insurance companies with $168 billion (10 percent), state and local government with $108 billion (7 percent) and CMBS, CDO and other ABS issues holding $52 billion (3 percent). Nonfarm non-corporate businesses hold $20 billion (1 percent).

CHANGES IN COMMERCIAL/MULTIFAMILY MORTGAGE DEBT OUTSTANDING

In the third quarter, agency and GSE portfolios and MBS saw the largest gains in dollar terms in their holdings of commercial/multifamily mortgage debt–an increase of $23.2 billion, (3 percent). Commercial banks increased their holdings by $12.1 billion (0.8 percent), CMBS, CDO, and other ABS issues increased their holdings by $10.6 billion (2.1 percent), and real estate investment trusts (REITs) increased their holdings by $4.9 billion (5.6 percent).

In percentage terms, REITs saw the largest increase–5.6 percent–in their holdings of commercial/multifamily mortgages. Conversely, federal government saw holdings decrease 2.0 percent.

CHANGES IN MULTIFAMILY MORTGAGE DEBT OUTSTANDING

The $31 billion increase in multifamily mortgage debt outstanding from the second quarter represented a 1.9 percent increase. In dollar terms, agency and GSE portfolios and MBS saw the largest gain–$23.2 billion (3 percent). Commercial banks increased their holdings by $4.4 billion (0.9 percent), and state and local government increased by $3.2 billion (3 percent). CMBS, CDO and other ABS issues saw the largest decline in their holdings of multifamily mortgage debt, down $835 million (1.6 percent).

MBA’s analysis is based on data from the Federal Reserve Board’s Financial Accounts of the United States, the Federal Deposit Insurance Corporation’s Quarterly Banking Profile and data from Wells Fargo Securities.

More information on this data series is contained in Appendix A.

To view the report, visit: www.mba.org/documents/research/3Q20MortgageDebtOutstanding.pdf.